How Laura Geller Beauty drove 3x ROI from TV with KNO

Imagine driving nearly 3x the incremental revenue from TV channels and doubling your budget while still meeting ROAS targets.

This isn’t just a hypothetical scenario—it’s exactly what Laura Geller achieved, allowing them to scale and capture a new customer segment, particularly in the upper funnel.

Laura Geller is a 9-figure beauty brand known for their high-quality products and innovative approach to beauty. But even the most iconic brands need to evolve. Enter Scott Kramer, Head of Growth at AS Beauty. Tasked with elevating Laura Geller’s reach and impact, Scott turned to KnoCommerce.

The problem: evaluating the performance of new channels

Challenge of Post-iOS 14 Attribution:

Scott and the team faced challenges, particularly in tracking and attributing conversions accurately. “There has been a lot of chatter post iOS 14 about attribution. We had been using multi-touch tools, and a post purchase survey was another data point we started to think about implementing, and utilizing to help evaluate the performance by channel,” Scott explained.

The team realized they needed more precise data points to truly understand and optimize their performance by channel. That’s when they started using post-purchase surveys as another data point to add to their attribution toolbox.

Uncertainty in Testing New Channels:

Traditionally, Laura Geller Beauty runs about three major brand marketing initiatives annually. These initiatives were often more organic in nature, but this time, they wanted to see how these campaigns performed from a top-of-funnel perspective with increased media investment.

“We aimed to track the impact and performance of these traditional brand campaigns,” they shared, “understanding the halo effect and how brand dollars scale via a non digital channel.”

This led the team to test the effectiveness of linear TV advertising, a move that marked a significant shift from their usual digital-focused campaigns.

The decision to test linear TV was driven by the opportunity to tap into lower CPM markets. With CPMs for linear TV ranging between $2 to $3, compared to $15 to $20 for connected TV, the team saw a chance to reach a broader audience without straining their budget.

“We felt that we really needed an additional touchpoint to measure performance because those channels are not measured in a traditional click attribution world.”

– Scott Kramer, AS Beauty Group, Head of Growth

But to maximize the effectiveness of their TV campaign, Laura Geller Beauty rolled out awareness campaigns across multiple platforms, including Meta, TikTok, and other social channels. They also prominently featured the campaign on their homepage and generated significant PR buzz. This multi-channel approach allowed them to gauge the overall impact of their brand marketing efforts.

An interesting challenge came up when tracking the effectiveness of these campaigns: they wanted to understand the overall lift effect, so they incorporated questions into their post-purchase surveys to gather insights.

Through the survey, they simply asked customers if they had interacted with or seen the campaign.

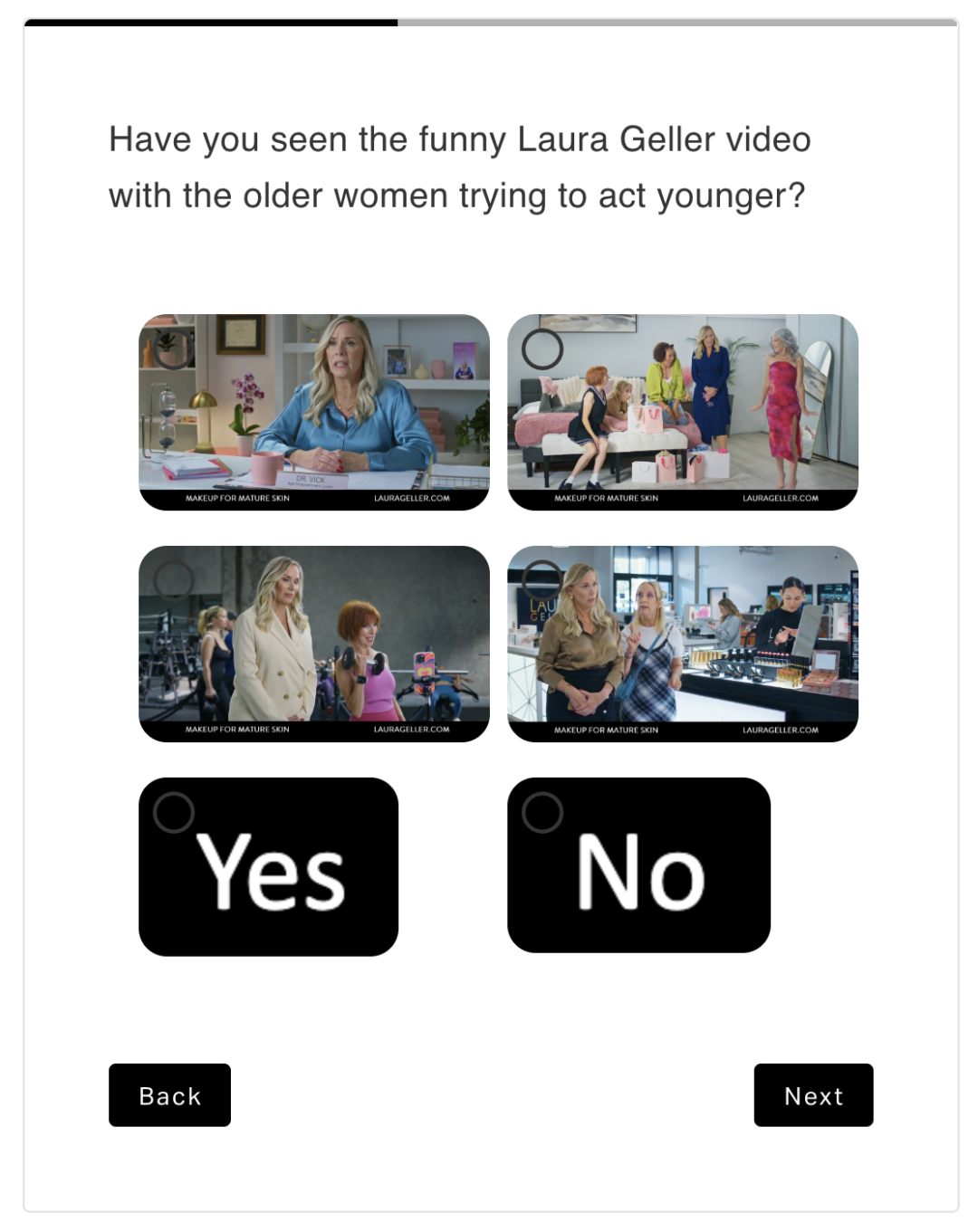

“The tough thing was, we had an internal name for the campaign, but that doesn’t actually mean anything to someone that viewed it. So we had to get creative with how do we asked our customers if they recalled seeing our campaign?”

So the team pulled in screen grabs from the campaign which had four different versions and used images they knew were important. Customers were first asked if they saw the campaign. In a follow-up survey, they were asked where they interacted with it—whether on a PR post, the website, organic social media, television, or ads on platforms like Facebook, Instagram, and TikTok. This approach helped the team identify which distribution channel provided the best brand lift, leading to eventual purchases.

The approach: building highly targeted post-purchase surveys

It’s true that everyone wants to diversify their channel mix but one key question was, how do all of the channels work better together?

Scott had this gut feeling that TikTok and Pinterest were doing more for the brand than the usual click data and wanted a way to see the full picture, so they turned to Kno to build out highly targeted post-purchase surveys.

Here’s how it unfolded:

By sending out these surveys, Laura Geller could ask customers directly about their interactions with various paid channels. The team then matched these responses with each channel’s spending, which allowed them to figure out a survey-modeled ROAS. This was done every month, giving them a clearer sense of their overall marketing effectiveness, especially when they didn’t have a full-blown marketing mix model (MMM) in place.

The overall understanding in the industry is that TikTok had this unique ability to drive incremental value, with users diving deep into content for research and entertainment. And Scott thought, “What better way to validate this than through post-purchase surveys?”

These surveys became an essential part of their marketing toolkit.

To measure the overall lift, they added a question to their surveys asking if customers had seen their latest campaign. Instead of using the internal campaign name—which wouldn’t mean much to customers—they used screen grabs from the campaign, featuring four different versions. They debated using videos but decided images would work best.

The follow-up survey asked where customers saw the campaign: Was it through PR posts, on their website, organic social channels, TV, or ads on platforms like Facebook, Instagram, and TikTok?

This allowed them to figure out which channels were really driving brand lift and leading to purchases.

It was like having a behind-the-scenes look at their marketing success, giving them the insights they needed to optimize their strategies.

What the Laura Geller team wanted to learn

With Laura Geller Beauty’s campaigns featuring glamorous shoots and high-profile celebrities, the question was clear: If they poured more into these campaigns, would the lift be worth it?

“Rather than diving into costly traditional brand lift studies or teaming up with big publishers, we wanted to see how we could extend our insights beyond the Meta platform,” explained Scott.

They had already been doing some brand lift studies within Meta, but saw an opportunity to get a broader perspective.

Previously, the team’s approach was straightforward but somewhat uncertain. They’d allocate a budget for a brand campaign, create a stunning asset, and then face the tough task of figuring out how much to spend on distribution. Without enough data, setting meaningful KPIs was like shooting in the dark.

Now, with more data at their fingertips, they could set clear KPIs and build accurate forecasts. For instance, if they aimed for a specific number of user impressions, they could better align their budget to meet that goal.

The old way of earmarking a percentage of the budget for brand marketing was just the beginning. Creating high-cost assets was one challenge, but distributing them effectively added another layer of complexity.

“We knew they couldn’t just hope for a viral moment; they needed a solid media distribution budget.”

The real trick was balancing the spend on distribution to ensure a worthwhile return on investment. By leveraging our insights, they could see how their brand campaigns were driving real revenue, validating the ROI of their investment and making more informed decisions about future campaigns.

Why did Scott choose KNO?

Scott had the team blushing when he commented on his decision to start using KNO:

“You guys have started to become a real leader in the space. I was seeing your content everywhere. For us, when we look at new vendors, a big part is identifying leaders and brands we aspire to or look up to, and whether they use similar technology. In our conversations, it felt like the right partnership.”

But that’s not all—Scott also highlighted how much they valued our seamless integrations. We’re talking smooth connections with Shopify, Klaviyo, and their other favorite tools. This made the setup a breeze and cemented their belief in a long-term partnership with us.

One of the big wins, according to Scott, was the setup process and working with our team on rolling out the questions for their post-purchase surveys.

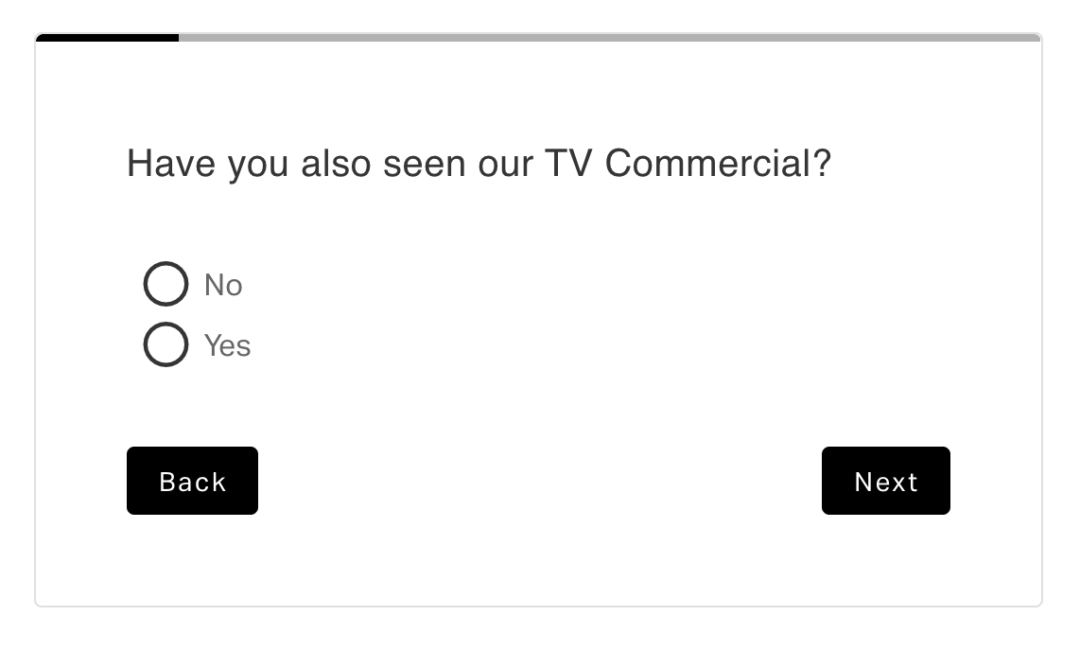

He admitted that initially, he didn’t think much about the specifics and just wanted to dive into asking questions. But when they started including questions about TV ads, they realized the wording was crucial.

Scott appreciated our team’s help in refining the questions—like deciding between “Did you see our TV ad?” versus “Did you see our TV commercial?”—to avoid leading customers toward specific answers. This level of detail is often overlooked, but working with our team to get it right was invaluable for them.

“I definitely did not even think about that when we were launching the post-purchase survey or even asking additional questions to really think about the psychology of how do you ask a question to get the right results? So that’s a huge aspect I think people can overlook at times, and that’s where I think it’s been great working with the KNO team to develop the right way to ask questions and make sure we aren’t leading the customer to a biased answer.”

Breakdown of Laura Geller’s survey: What they’re asking and why

Here’s a look into the survey questions designed to map the customer journey from discovery to purchase.

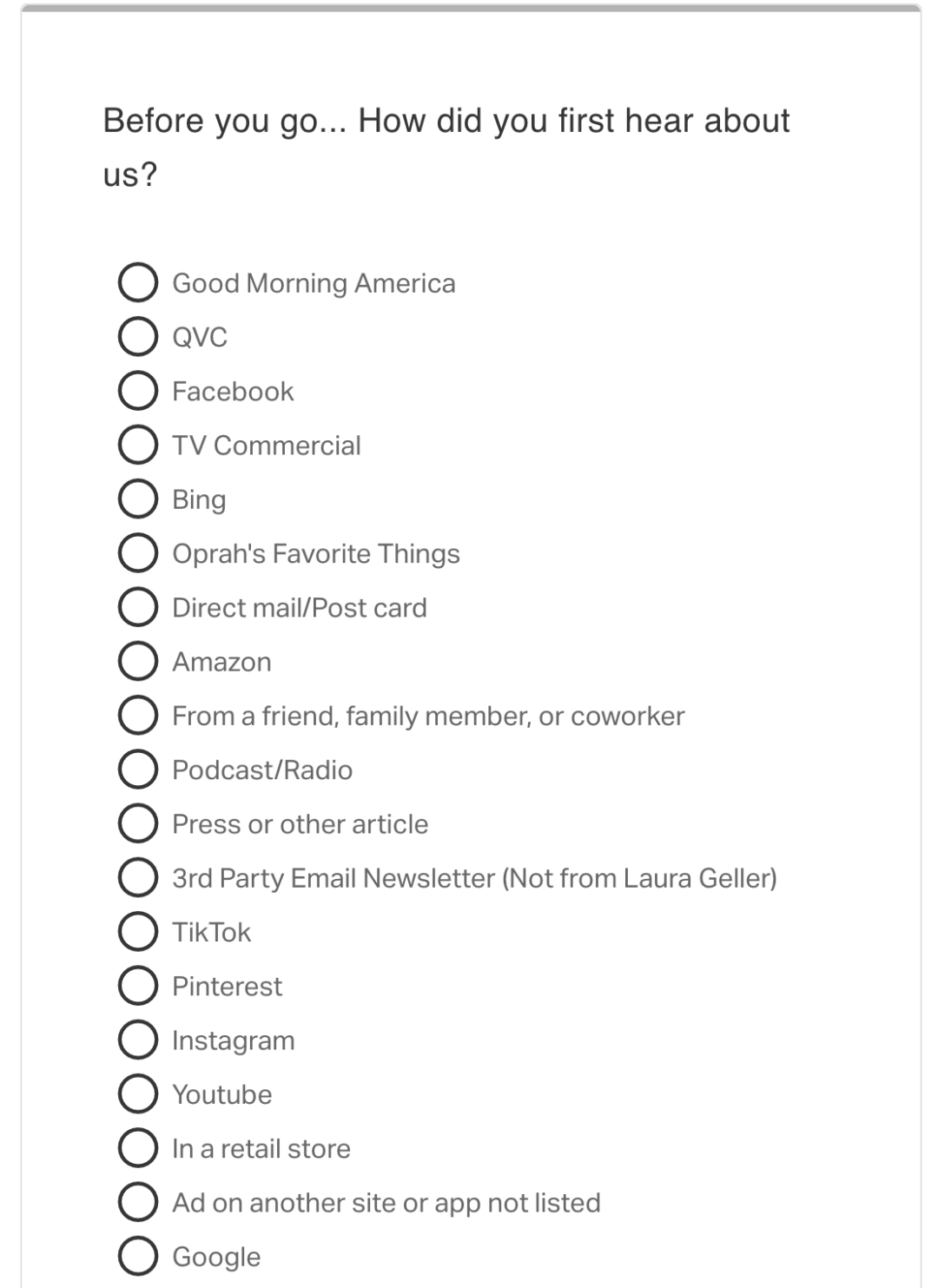

They start by asking, “Before you go…How did you first hear about us?” This question is pivotal in identifying the initial touchpoint.

They then follow up by asking, “What brought you to the site today?” or “What drove you to make the purchase?” Which helps pinpoint both the initial and final touchpoints in the customer journey.

It’s important to recognize that there’s much more happening in between these stages. The frequency of touchpoints before a purchase can vary greatly, and capturing this is key.

An eye-opening insight is one that came from their follow-up questions.

For example, if a respondent mentions discovering Laura Geller through a digital channel like Facebook, TikTok, or Pinterest, they would then ask if they also saw our TV commercial. This approach has unveiled the synergy between TV and digital channels.

As Laura Geller Beauty increased their TV ad spend, they observed a significant lift in Facebook performance. Customers who saw our TV ad often followed up with clicks on our Facebook or Instagram ads, leading to purchases. This finding demonstrated that TV ads enhanced the effectiveness of our digital campaigns, reducing the need for excessive digital exposure alone.

The team also meticulously track and model their ROAS by correlating survey responses with marketing expenditures. For instance, if a respondent indicates they saw a TV commercial, they attribute revenue to our TV ad spend.

The data shows that the proportion of people engaging with TV ads is two to three times greater than our actual TV investment, validating TV as an effective channel. This not only provides direct attribution but also reveals a halo effect, reinforcing TV as a powerful top-of-funnel strategy.

Laura Geller’s findings:

TV isn’t a dead medium for advertising

For some time, TV has been seen as a dying channel by many as it’s always been tough to prove its effectiveness.

The biggest challenge? Justifying the spend.

With digital channels like Meta, tracking ROAS and adjusting spend is a breeze. But TV? It’s a whole different ball game. Brands pour money into TV ads without seeing a direct sales bump, which naturally led to budget worries and skepticism about whether it is worth it, which Scott related to with Laura Geller.

However, with more data points from Kno, they started to build trust in TV as a channel again. Realizing that understanding how to buy TV ads was crucial—it’s much more complex and has a longer payoff period. Initially, they were pretty skeptical about TV’s performance. They thought, “Is it really worth it?”

Then came the breakthrough. With Kno’s insights, they could gather and analyze more data, making the impact of TV ads much clearer. They saw TV’s value, and it became their second biggest channel, right behind Meta. It was a complete game-changer, transforming how they viewed and utilized TV advertising.

So, while TV might seem like a thing of the past to some, Laura Geller Beauty was able to find a way to make it work, thanks to the power of data and a fresh perspective. And it goes to show that sometimes, looking at things differently can uncover surprising opportunities.

Using PPS beyond attribution & saving marketing budget on unnecessary projects

As the Laura Geller Beauty team worked through a website redesign and overhaul Scott mentioned a big decision the brand faced: Should they invest in a costly site redesign and reshoot their model images? A big undertaking.

To get a clear picture of what their customers thought, they used a post-purchase survey. The team included a simple question: “Do you feel the images of our models are outdated?”

The response was clear—about 90% of customers said they still connected with the models. This feedback was huge. It showed that while the models might be somewhat outdated, they still resonated with their customer base which helped Laura Geller Beauty make a more informed decision without the hefty investment of a full reshoot and site overhaul.

By leveraging post-purchase surveys, Laura Geller Beauty tapped into customer sentiments, extending beyond just marketing attribution. This approach not only validated their customers’ connection to the brand but also, as Scott put it, saved them “tens of thousands of dollars.”

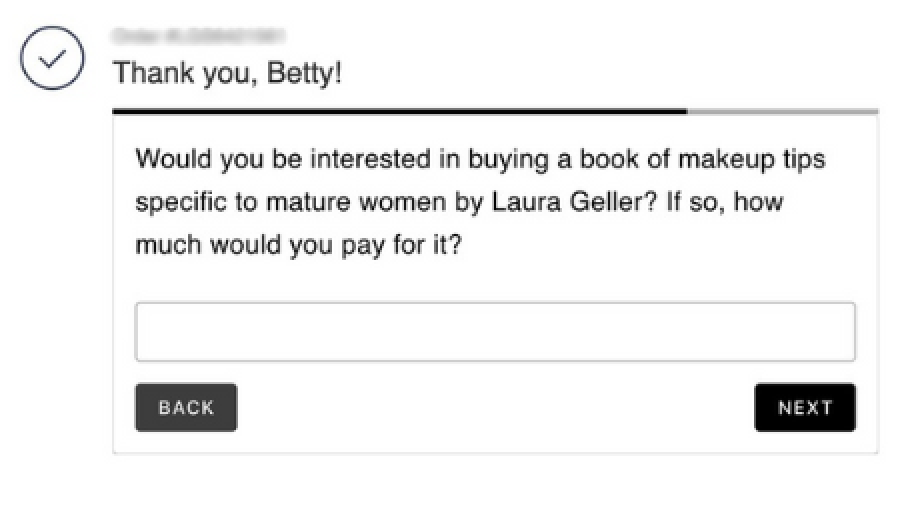

Customers can and should guide your product development

As far as product development goes, the ability to hear feedback from customers is a game-changer. Scott explained that by asking customers questions like, “If we go into X new category, are you interested? Would you buy this product?” and “What new products would you love to see?” they were able to build a solid waitlist and gathered invaluable feedback from their customers.

It was super useful for their product team, as well.

“Getting feedback from real customers about what they want is priceless, especially when it means avoiding expensive research trials, which can cost anywhere from $20-$50K.”

It helped them tweak their product plans to better match what their customers want and avoid other expensive feedback avenues.

Unlocking new revenue channels

Laura Geller Beauty achieved a remarkable increase in incremental revenue from TV channels, seeing a boost of 2.5 to 3x. This success not only allowed them to double their TV advertising budget but also to maintain their return on ad spend ROAS targets.

“It has been pivotal in helping us scale and reach a new customer segment, particularly via upper funnel media.”

Building customer cohorts

The team is using the data from post-purchase surveys to create personalized customer journeys and dig into some serious backend analytics.

By analyzing which age groups buy specific products, Laura Geller can pinpoint customer segments with the highest LTV and find new customers who are likely to drive future revenue. As Scott put it:

“We’re using what we hear from our customers to better address potential pain points in the market with our creative and find new ways to market to people who can help grow our business.”

Start learning everything about your customers, directly from them

Laura Geller Beauty’s use of KnoCommerce transformed their marketing strategy, leading to a 3x ROI from TV channels and significant revenue growth. By leveraging post-purchase surveys, they gained precise insights into customer behavior and campaign effectiveness, enabling informed decisions and optimizing their marketing budget.

Ready to learn how KNO can help your brand achieve similar results? Schedule a demo with us today!

Our team is here to help you find the right fit for your business.

KNO is a cheat code to attribution that’s totally legal

-

Templates

Extensive survey template library that powers over 1M+ survey responses per month

-

45%+

Average response rate

for all survey types -

Fast Returns

Increase ROI with targeted survey actions ie. app downloads, loyalty programs and social media interactions