What makes someone add a product to their cart and actually follow through with the purchase?

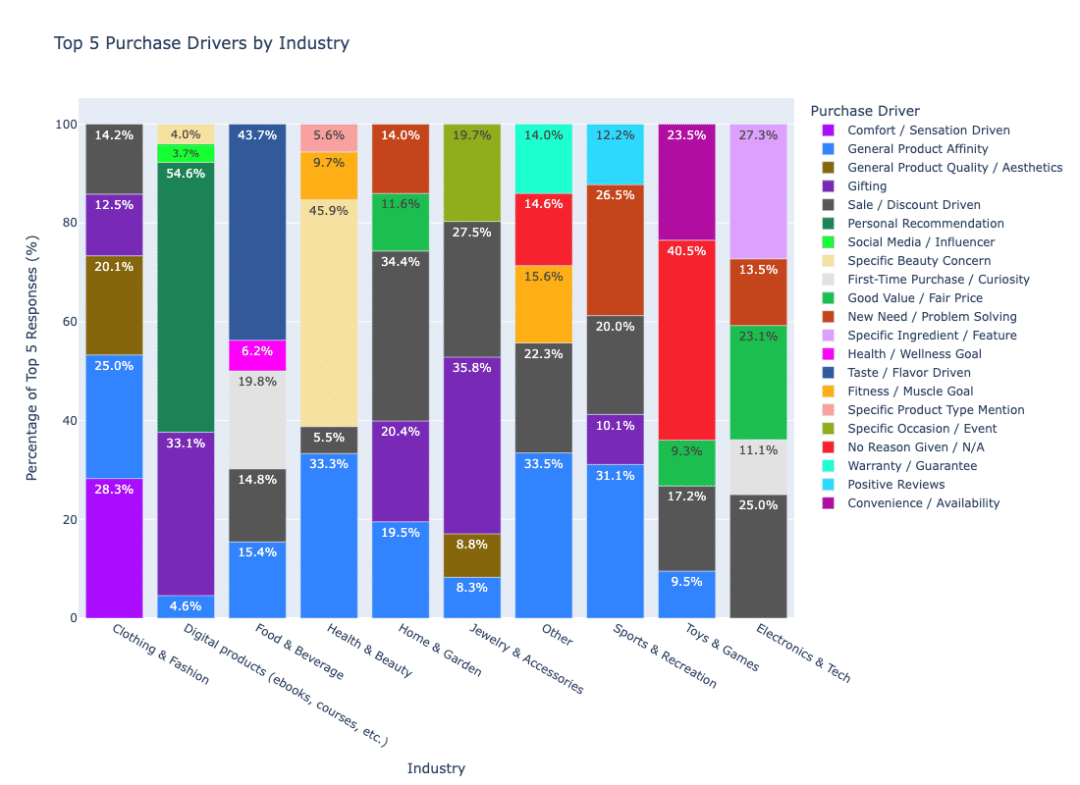

Consumer decision-making behavior is deeply influenced by the type of industry. The reasons someone buys skincare are completely different from why they subscribe to a digital tool or order takeout on a random Tuesday night.

To understand how consumers make purchase decisions, you have to understand what motivates them at each stage of the customer decision journey.

Let’s unpack what actually pushes someone from “maybe” to “yes”—and how it varies across industries.

Different industries, different drivers

The consumer decision process isn’t just about needs; it’s about timing, emotions, trust, and product relevance. Here’s how it plays out across four industries:

Health & Beauty: 45.9% buy to solve a specific concern

Nearly half of Health & Beauty shoppers are intentional. They’re not browsing—they’re looking for a solution to a problem: dryness, acne, sensitivity, aging, etc.

That means brand consideration starts early in the buying cycle, and once someone finds a product that works, they tend to stick with it.

The post-purchase evaluation also plays a key role—because if the product delivers, retention is almost automatic. They could even opt in to subscribe and save, making it a lot simpler to keep them.

Often, the wording for health is consistency. You need to be consistent to see results, and brands brilliantly play on that idea with the subscribe and save offer that keeps consumers coming back.

JSHealth immediately bolds “Consistency is key” to build loyalty, suggesting that if they stop, results won’t happen. Additionally, discouraging the idea of going elsewhere for vitamins, as it would essentially mean starting over.

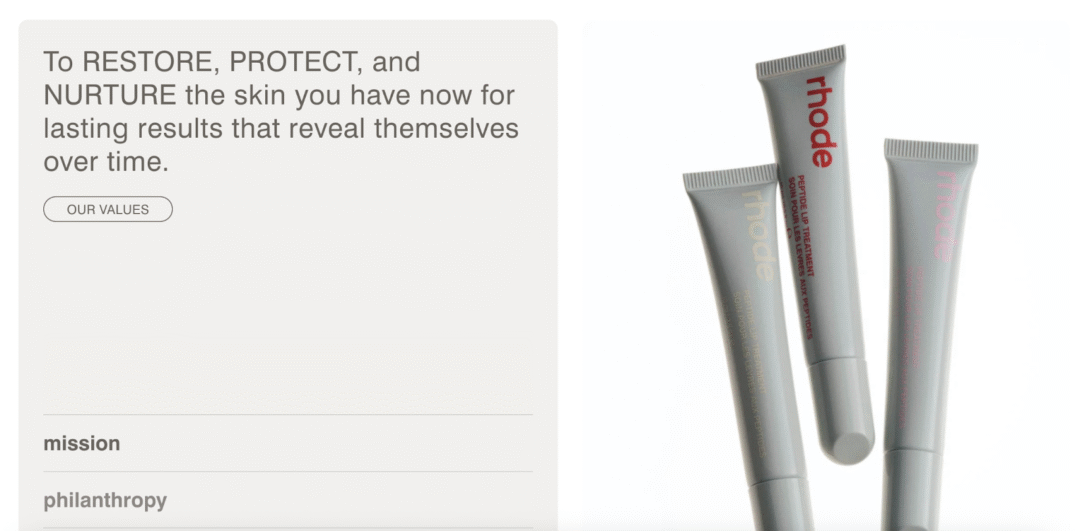

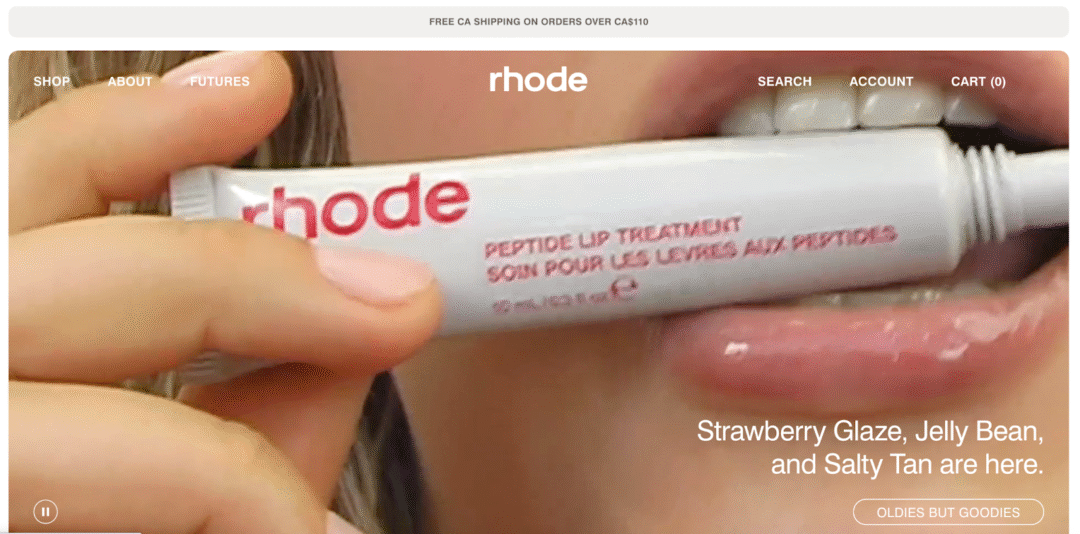

If someone’s into Rhode skincare, for example, they’re not just buying once. They’re coming back—and likely trying out all the new products. JB then makes a song about the phone case, and you also need to have that.

Rhode is also building on the idea of consistency. They clearly state that skin will feel great over time, suggesting that loyalty and consistent use are key to seeing results with Rhode.

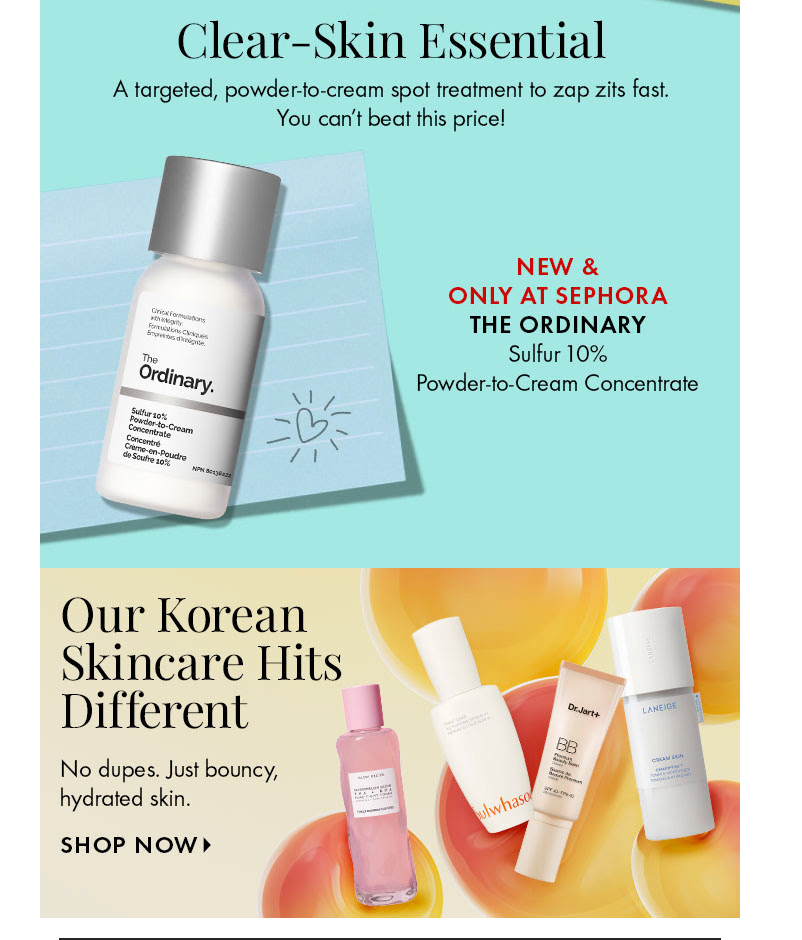

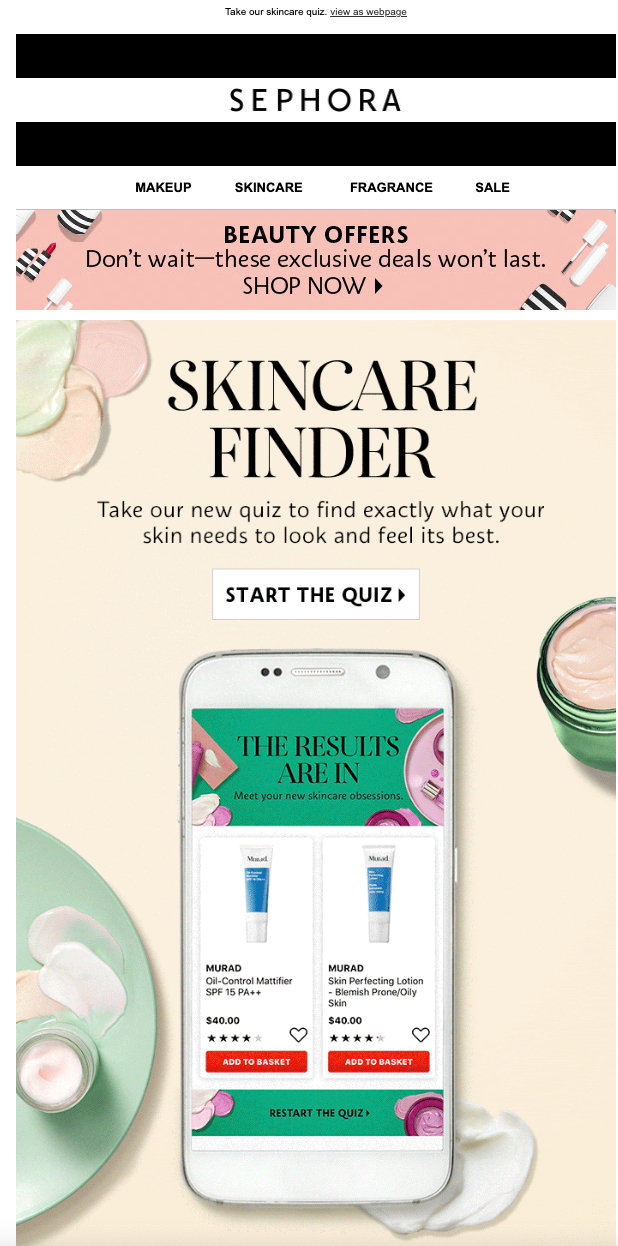

Sephora is arguably one of the largest beauty retailers, with a massive product catalog that can easily feel overwhelming. In their emails, they simplify the experience by marketing each product with just a few words—usually framed as a solution to a specific issue—making it easier for consumers to decide and guiding them toward what they’re looking for. Basically, serving what they are looking for on a silver platter, so it’s an easy add to cart purchase.

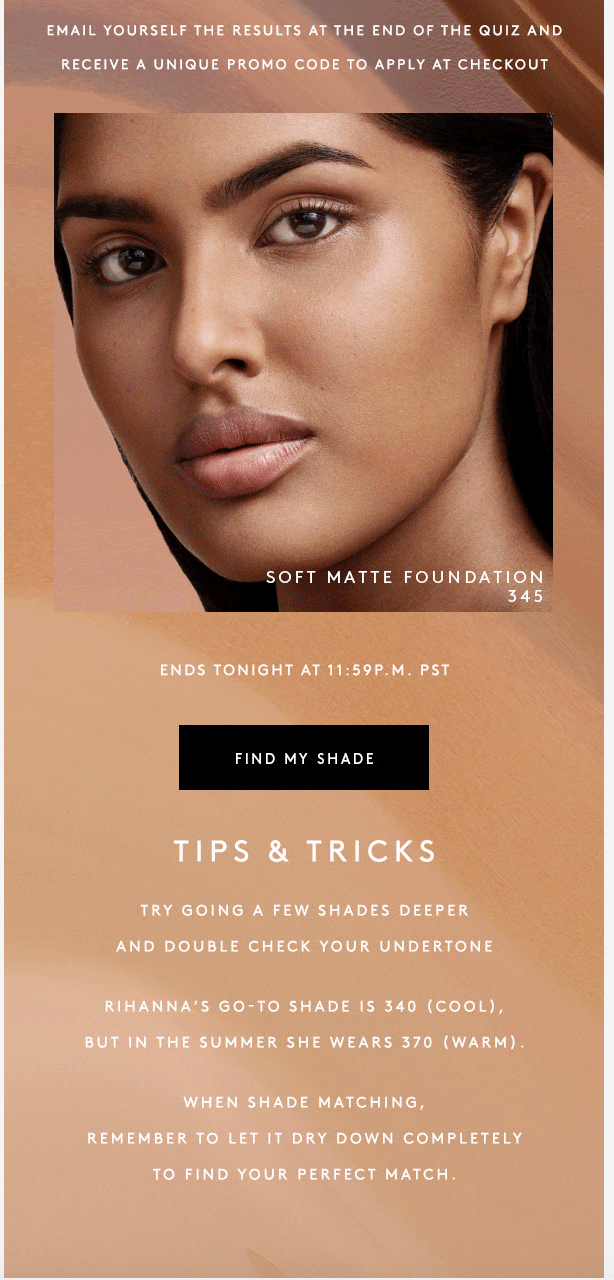

Fenty Beauty also uses education as a way to attract consumers and build trust. This approach not only creates a sense of reliability but also offers a solution to a common problem — uncertainty about how to use a product.

By educating their audience, Fenty helps consumers feel confident and informed before even making a purchase, which makes it easier to build long-term loyalty. People buy and stick to what they know, so using this tactic can make people who don’t know feel like they know a little, offering extra reassurance of their purchase.

Brands are also tapping into the idea of intentional shopping. Pre-purchase surveys in the beauty and health space help brands better understand their consumers, while also giving shoppers more confidence in the products they’re choosing. Quizzes, in particular, make the experience feel more personalized and reassuring.

One of the main reasons people shop in the health and beauty industry is to solve a problem. With surveys, there’s no need to guess—consumers will literally tell you what they’re looking for, allowing brands to filter products based on their answers.

This is the closest to consumers handing you a credit card and opening a tab. They know they’ll likely buy, not sure exactly what or how many, but they are ready when they figure it out.

Food & Beverage: 43.7% are taste/flavor-driven

In the Food & Beverage space, consumer psychology is heavily influenced by our senses… shocker. Taste is, of course, what keeps people coming back, but at first you need to sell something people haven’t tasted yet.

Subscription-based models—especially for essential products—thrive on convenience. Once customers see value and are satisfied, they’ll keep those automatic payments going without a second thought.

Factor Meals is a great example. Their strategy begins with deep discounts to hook people on their fresh meals. Once that convenience becomes part of their routine, customers are much more likely to stick around at full price.

Factor is also nurturing leads by leading with information and transparency, immediately giving people peace of mind knowing they can easily cancel, pause, or skip weeks.

Sensory-driven content—think close-ups, high-resolution product shots, and crisp ingredients that you can basically taste. Bonus points if you can see the crisp in the lettuce or the frost on a gold glass of Diet Coke.

Good Protein does sensory content simply and well. Their protein shakes look like milkshakes, but they’re actually packed with veggies, protein, and fiber. In this messaging, they follow these delicious shots with reviews highlighting just how tasty the products are. The shakes don’t just look like your favorite dessert; the reviews validate that they taste just as good.

Good Protein also has a subscribe-and-save offer to build loyalty and retention. Their subscribe-and-save program helps introduce new products to consumers.

They make it easy to swap flavors if you want to try something new in your order. For the first five orders, they offer a free product—like Green Juice, Collagen, Tote Bags, and more.

After that, subscribers get 25% off every order moving forward. Through this, they’re building retention while also introducing new products that customers can add on later.

Digital Products: 54.6% come from personal recommendations

Over half of purchases are driven by trusted referrals—usually from family, friends, and influencers. Influencer marketing is absolutely wild; people treat influencers like personal recommendations, which, from a brand standpoint, is a big win. TikTok has become the hotspot for these kinds of recommendations.

When it comes to bigger purchases, people tend to do more research to really understand and feel confident about what they’re spending on. For back-to-school season, you’ll see students and professionals recommending devices tailored to their specific fields.

If you’re an interior designer or aspire to be one, this laptop may be one you consider more than others because someone who appears to be a successful interior designer is swearing by it.

This is also an industry where education goes a long way because it builds trust. Similar to the previous example, TikTok influencers easily communicate the value of the laptop they use.

Consumers are more willing to trust them because they not only demonstrate knowledge of the product but also show that they rely on it for the lifestyle/job they have, likely a job that’s similar to what the consumer wants.

Example:

For higher-priced digital products, customers tend to move through the 5-step decision-making process slowly: awareness, interest, evaluation, purchase, and post-purchase reflection.

What really drive high-AOV decisions

Here’s what we know for certain: deals don’t drive your best customers.

Promotions can for sure bring in volume, but your highest-AOV customers aren’t discount shoppers. They’re the ones that you built a relationship with. They are motivated by trust and a positive experience during every step of the customer decision journey.

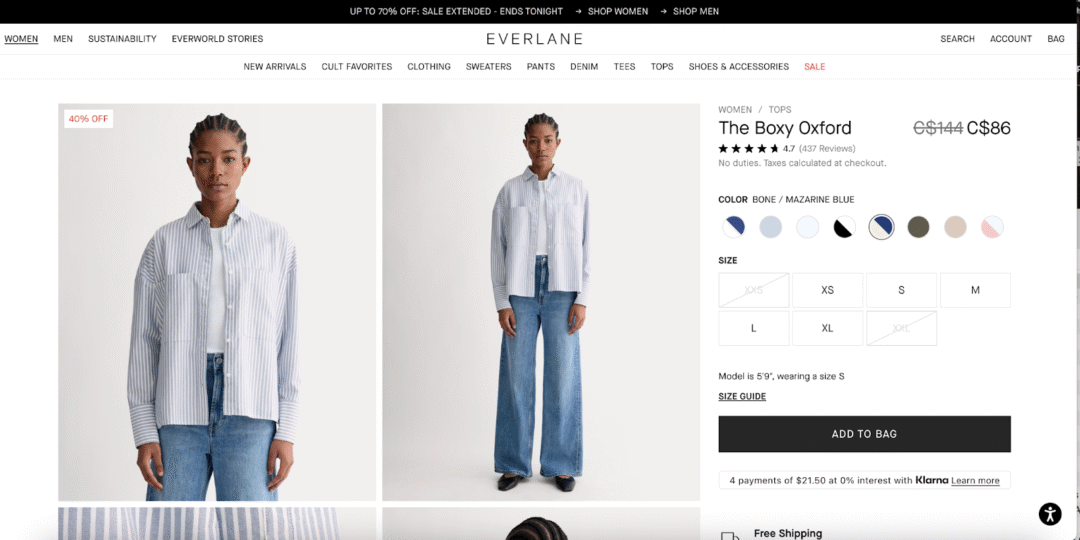

In fact, total cost transparency (including shipping, fees, and duties) matters more to these customers than discounts.

And Everlane gives consumers that extra piece of mind with one simple sentence: no duties. Taxes calculated at checkout:

Right away, you know what you’ll pay at checkout is final—no surprise bills at your door. They also make it clear that prices are pre-tax, so consumers can expect the final price to include taxes.

Rhode is transparent about their shipping, immediately letting consumers know that free shipping is available only in Canada on orders over $110. This clearly communicates that anything less, or shipping outside Canada, will include a shipping cost in the total price.

For many high-AOV customers, brand alignment is everything. If your values resonate with them—whether it’s sustainability, inclusivity, or ethical sourcing—that can justify a premium price.

Another great example is Dove. Their campaign directly relates to their values as a brand, positioning themselves as a “protective big sister” which can resonate with their audience.

These customers aren’t just buying a product; they’re buying what your brand stands for. This is why customer loyalty factors like trust, mission alignment, and long-term brand consistency are so critical. Customers who trust you and your values are more likely to hand over their credit cards.

And sometimes it’s not about the thing, it’s about how it makes people feel. High-value customers don’t just want products but lifestyle experiences.

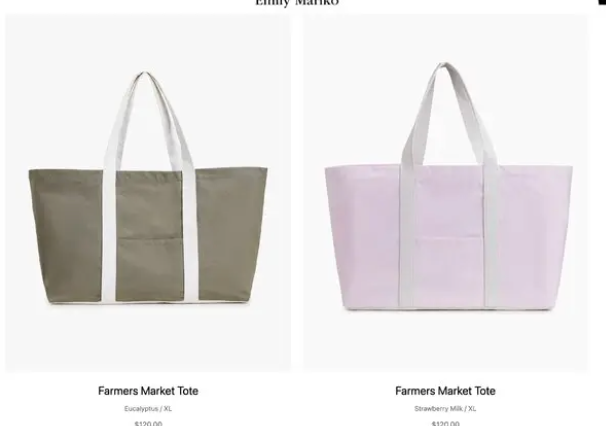

A prime example is Emily Mariko’s $120 farmer’s market tote bag. If you’re wondering what a farmers’ market bag is, it’s just a tote bag.

People will spend almost any amount if they believe that adopting her lifestyle and products will positively impact their lives. They’re not chasing a deal—they’re buying into the idea of bettering themselves and showing up as a better version.

Whether it’s cozy loungewear, luxury skincare, or a digital tool, consumers are drawn to products that support the version of themselves they want to become.

In one of Apple’s campaigns, they feature different artists as the faces behind the Mac. This brilliant yet simple move shows consumers that if you want to be an artist—if you love music, producing—this successful person uses a Mac.

It makes you feel like, with a Mac, you’d have the tools to accomplish what you want and live the life you’re dreaming of. And when products directly support productivity or daily function, they feel easier to justify.

Final thought

Why people buy varies depending on the product, industry, and consumer. What drives people to spend the most also depends on those factors.

Except you don’t need to guess. There are ways to understand consumers and address the problems your shoppers are looking to solve.

With pre-purchase and post-purchase surveys, you can simply ask consumers what they want or need. If consumers aren’t sure, you can ask what they’re looking for with surveys and quizzes, and then position your product as the solution.