Your best customer data happens before the sale.

Yet… Getting the right customer data can feel like working in the kitchen of The Bear — a stressful balancing act.

Put all your focus on acquisition and your customer acquisition costs (CAC) can spiral out of control. Rely only on post-purchase feedback and you’ll miss insights from the shoppers who never completed their purchase in the first place.

Don’t worry, chef.

There’s a better way.

Pre-purchase surveys let you capture critical shopper intent and feedback before they buy. By asking the right questions at the right time, you can uncover motivations, hesitations, and context that help you improve targeting, messaging, and conversion rates.

In this article, we’ll explore:

- What pre-purchase surveys are

- Why they’re so powerful

- The 4 different types of pre-purchase surveys (with examples!)

- How real brands are using them

- How you can implement them to beef up your customer data

- A free question bank to get you started

Pre-purchase surveys: Get in the KNO before they go

Pre-purchase surveys are brief, targeted questions that you ask a customer before they complete their purchase.

While post-purchase surveys gather customer feedback after a sale, pre-purchase surveys are used to capture shopper-intent and concerns in real-time.

You can gather shopper intent feedback, obstacles to completing a purchase, and other key information before customers abandon their cart and then again through cart abandonment surveys.

Common formats include:

- Pop-ups on product detail pages

- Exit-intent campaigns

- Embedded forms during the checkout process

- Retargeted emails and/or SMS

Understanding the data goldmine that is pre-purchase surveys

So why ask pre-purchase questions? They’ll help you:

- Identify friction points early: Did you know that 70.19% of carts were abandoned by customers in 2024? From unexpected costs to confusing checkout processes, many of these issues are completely fixable and avoidable—if you can identify them.

- Segment shoppers by pre-purchase intent and concerns: Building segments of VIPs, dormant customers, gift buyers, or other groupings is common practice. However, segmenting shoppers before they purchase is equally as valuable. For instance, you can follow up with customers who are shopping for gifts around the holidays or send targeted promotions when products that the customer is interested in go on sale.

- Collect zero-party data: Customers don’t just want personalization, they expect it. Luckily, Gartner reports that 77% of consumers are willing to share personal data for a more personalized experience. This is called zero-party data and pre-purchase surveys are a great way to collect it so you can enhance personalization for your customers.

Four types of pre-purchase survey questions to start asking today

Typically, all pre-purchase surveys are short, low-friction questions that are seamlessly embedded in the shopping experience through: exit-intent pop-ups, checkout flows, or product pages. The types of surveys fall into 4 categories:

- Purchase intent surveys

- Barriers to purchase surveys

- Attribution surveys

- Customer or buying context surveys

Asking the right questions can help you directly influence purchase decisions, boosting conversions, reducing friction, and improving the relevance of your marketing in the process.

Next, we’ll break down what each category means, why it’s important, and, since we’re feeling generous, share some sample questions you can use for each one.

Purchase intent surveys

These surveys help you understand why your customers are visiting. Are they browsing casually? Researching you and your competitors? Ready to buy today? Knowing their intent lets you tailor messaging, urgency, and follow-up promotions accordingly.

Purchase intent survey questions are important because the insight they provide can help optimize product or checkout page content based on why your customers are visiting you in the first place.

If they’re looking for competitive research, provide them with specs and product information. If they’re ready to buy, remove any pre-purchase barriers and allow them to check out quickly.

Example questions:

- What brings you here today?

- Are you shopping for something specific?

- What problem are you trying to solve?

Barriers to purchase surveys

They say the only things certain in life are death and taxes, but if you run an ecommerce store, add cart abandonment to that list too.

Customers abandon their carts. A lot.

Sometimes, for reasons beyond your control, but other times it may be due to on-site roadblocks or a complicated purchase process.

Signaling a pre-purchase survey whenever a customer shows signs of leaving your site can tell you a lot about any potential friction points on your website that are costing you sales, like missing product information, unexpected fees, or a confusing checkout process.

By fixing these roadblocks you’ll not only improve your purchasing process from end-to-end, you’ll lower your cart abandonment rate too.

Example questions:

- What’s holding you back from purchasing today?

- Is there anything missing from this page?

- What’s your biggest concern about buying?

Attribution surveys

With customer privacy laws becoming stricter and stricter, getting your hands on third-party data is harder than ever. This makes it challenging to understand where your customers are actually coming from.

The solution? Just ask them!

Attribution data will validate or challenge what your analytics tools report, guide your marketing channel investments, or tailor your messaging for individual channels.

Example questions:

- How did you find us?

- What brought you to our site today?

- Did a friend refer you?

- Did you see us on social media?

Customer or buying context surveys

Customers aren’t monolithic, but without the right data, it’s hard not to treat them like they are. Understanding how your customers differ is the first step to carefully tailoring your messaging.

Are they buying for themselves or someone else? Is this an urgent purchase or are they budgeting for later? By knowing your customers’ circumstances, you can improve product recommendations, tailor urgency messaging, or even shape seasonal campaigns.

Example questions:

- Is this for you or a gift?

- What’s your budget range?

- When do you need this item?

- Is this for a special occasion?

How brands are using pre-purchase surveys

Setting up pre-purchase surveys and collecting data is only half the battle. In keeping with our Bear theme, what good is top-tier kitchen equipment if you don’t know how to use it?

The most successful brands don’t just use pre-purchase surveys to collect customer insights — they’re able to effectively use those insights to improve their marketing and customer experience.

Your zero-party data can help you refine messaging, personalize experiences, and make smarter decisions across all touchpoints.

Here are some strategies for strategically leveraging zero-party data alongside some real-world success stories:

Dynamically adjust on-site messaging based on customer objections

While some customers are leaving your site because they have to get back to work or got distracted by their cat, there’ll always be customers leaving because of your on-site or purchase experience.

Many shoppers don’t convert because something on the page causes hesitation. Unclear sizing, shipping questions, doubts about the product details… You often can’t identify the issue until your customers tell you the issue.

Once you know why they’re leaving, you’ll know how to fix it. Common fixes include:

- Getting the right content in the right places: For example, a clothing store could add size guides above the fold or in pop-ups to make sizing clear to new customers.

- Rewriting product copy to address common concerns or objections: If an important aspect of your product category isn’t easily identifiable in your product description, adjust your copy to make it so.

- Restructuring product detail pages or checkout flows to remove friction: For example, offer one-click checkout through a platform like Shopify as opposed to multi-page flows.

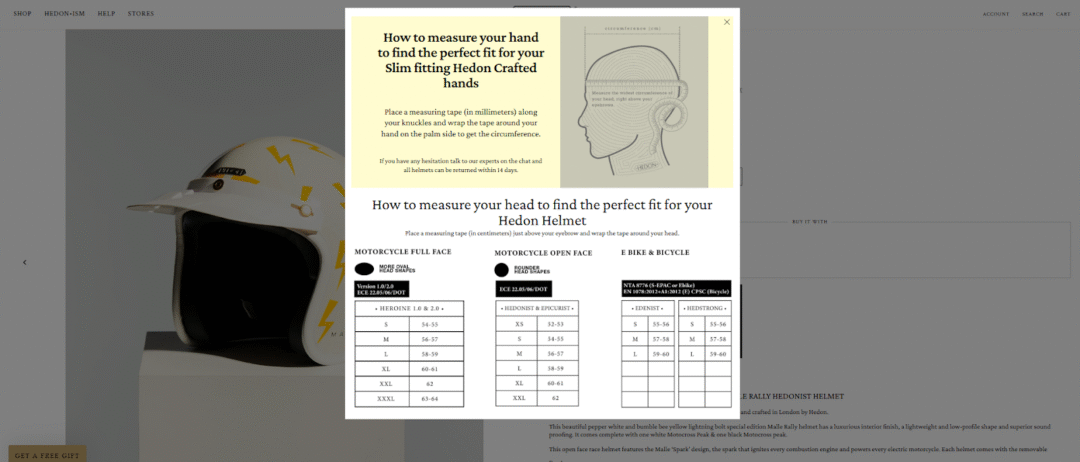

How Hedon Helmets protected their revenue with a clearer size guide

KNO users Hedon Helmets offer some of the best motorcycle helmets on the market, so they were understandably confused when they noticed visitors bouncing from product pages.

After digging into the data from pre-purchase surveys built with KNO, they noticed customers were leaving because they couldn’t easily find the sizing guide.

To correct this, Hedon implemented the sizing guide as a prominent pop-up on the product page. This resulted in a 12% increase in revenue per visitor, lower bounce rates and higher conversion rates across the board.

Looks like they finally found the right fit!

Segment audiences for personalized marketing flows

Zero-party data collected from pre-purchase surveys isn’t just about immediately increasing conversions. You can also use it to foster long-term customer relationships and nurture prospective buyers towards a sale. This comes in handy for products that tend to have longer purchase cycles, such as furniture or high-end electronics.

A great strategy is to build personalized email and SMS flows based on a shopper’s intent, context, and hesitations. Here’s how:

- Tag survey responses in platforms like Klaviyo to power your segmented flows

- Send follow-ups to your “just browsing” visitors to begin educating them over time

- For gift buyers, offer them timely reminders and delivery cutoffs near the holidays

- Trigger different flows for new and returning customers

How Hexclad cooked up a video series for hesitant buyers

Hexclad makes high-performing hybrid cookware with the durability of stainless steel and the benefits of non-stick cookware. But there’s one thing they did want to stick: prospective customers.

Using surveys built with KNO, Hexclad was able to differentiate returning customers and first-time visitors. While planning a new video series, they segmented their audience to specifically target subscribers that had never made a purchase, soliciting feedback on why they never took the plunge.

Using this feedback, Hexclad crafted messaging that addressed the key hesitations outlined in the surveys, such as price sensitivity and product confusion. This led to more effective content and stronger conversion performance over time, proving that Hexclad is definitely using the right ingredients for success.

Optimize ad spend by putting money behind high-intent channels

With attribution data being harder than ever to get, attribution questions can fill these analytics gaps for you in a post-cookie world. By using pre-purchase surveys, you can identify which channels are actually driving high-intent traffic and reallocate budget accordingly.

By using zero-party data to determine where your users are coming from, you can:

- Prioritize specific paid or organic marketing channels based on real data, not assumptions

- Improve your ROAS by cutting spend on low-intent sources

- Build paid audiences using zero-party data

How Backbone Media discovered earned media was the backbone of a sales surge

Like all agencies, Backbone Media, an agency focused on connecting brands with outdoor enthusiasts, knows the increasing difficulty of obtaining solid attribution data. This was particularly noticeable when a client of theirs had a sudden sales surge that couldn’t be tied to any existing campaign.

Pre-purchase attribution questions were able to solve the mystery: earned media!

A popular review from Consumer Reports, syndicated across multiple channels, was driving the surge. From there, Backbone was able to capitalize on that momentum by amplifying the coverage on social channels.

More good work, less guesswork: Start using pre-purchase surveys

Implementing pre-purchase surveys with KnoCommerce means no more guessing.

It means saying “yes, chef” to exactly what your customers are telling you.

Remember, it starts with asking the right questions before a shopper makes a purchase. Start implementing pre-purchase surveys today using our free survey question bank with 200+ questions and start marketing smarter.