At the point of purchase, a new chapter begins in the customer’s relationship with your brand—it’s not the final page. This moment is also your lowest-friction opportunity to collect valuable, direct feedback from your customers.

And the insights you gather can play a crucial role in shaping your Black Friday and Cyber Monday (BFCM) go-to-market (GTM) strategy.

With BFCM just around the corner, here’s how you can use Post-Purchase Surveys (PPS) to drive better decision-making and fine-tune your approach.

Most shoppers don’t buy immediately—Plan accordingly

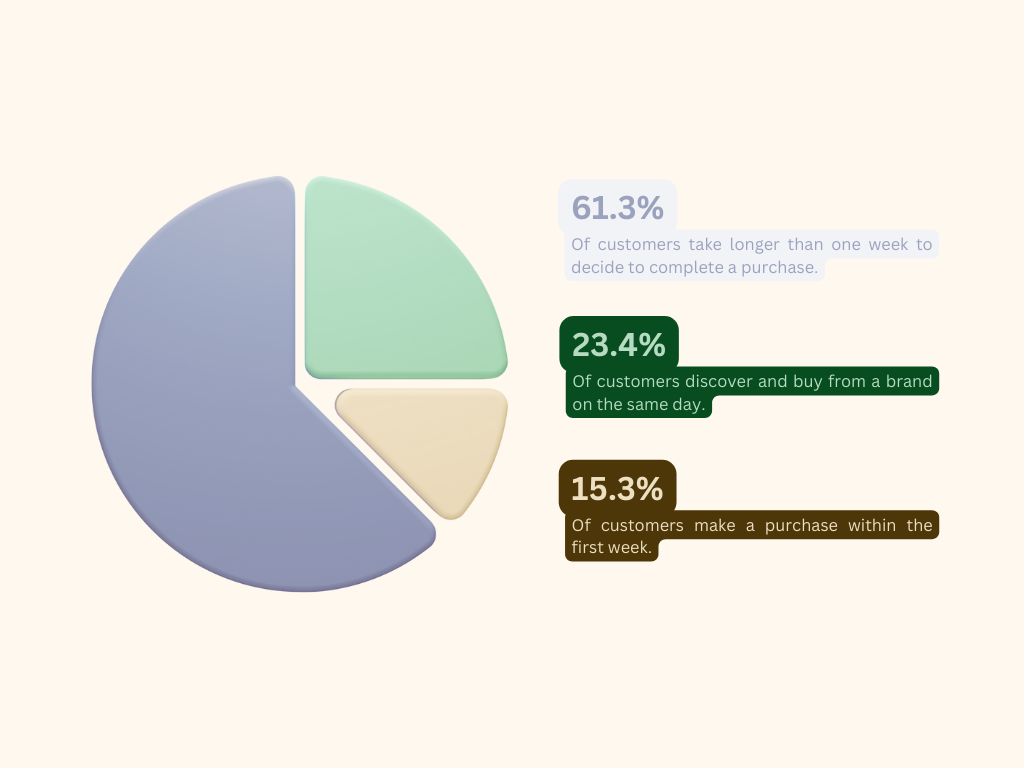

Our KnoCommerce 2023 Consumer Behavior Report revealed that 61.3% of shoppers take longer than a week to decide on a purchase.

This means that even though they’ve visited your site, many are not converting right away. To be prepared for the upcoming holiday season, setting up your PPS now gives you time to gather actionable data that will inform your BFCM strategy.

To get started, here are two critical steps:

- Segment customers by new vs. returning

By dividing your audience this way, you can ask questions that are relevant to each group, maximizing the value of your survey insights. - Ask questions that drive meaningful change

The questions you choose can make a significant difference in the quality of the feedback you receive. Tailoring your questions to where your brand is in its growth journey is key.

For example…

For newer brands (< $1M-$2M in annual revenue)

Ask: “Was there anything that almost prevented you from buying today?”

This simple yet powerful question uncovers the hesitations and obstacles your potential customers face. From there, you can take specific actions to address these concerns.

Responses we’ve seen have helped brands do things like,

- Introduce Buy Now/Pay Later options to reduce purchase friction.

- Refine your website copy to better highlight value propositions that may have been overlooked.

These small tweaks can have a major impact on converting hesitant shoppers into buyers.

For established brands (~$2M+ in annual revenue)

Ask: “Was there anything difficult about using our website today?”

Start with a simple yes/no, followed by an open-ended prompt if they answer “yes”: “What was it?”

While direct questions often provide clear, actionable insights, open-ended questions can uncover deeper opportunities. This type of feedback might reveal issues you didn’t know existed, such as:

- Hidden checkout errors that could be costing you sales.

- Limited customization options (like product bundling or color selection) that frustrate customers.

These are valuable insights that can help you refine your user experience and capture more revenue.

And yes, you can ask more than one question. In fact…

Long surveys—Yes, they work!

You may assume that post-purchase surveys need to be short to get responses, but that’s not always the case. In fact, longer surveys can yield a wealth of insights.

Take, for instance, the longest PPS we’ve seen—it had 26 questions. You might expect a high dropout rate, but here’s what happened:

- 45% of respondents completed the first 5-6 questions.

- 18% of respondents continued on to answer another 20 questions 🤯.

This extra data came at no cost to the brand. Yet, many brands shy away from longer surveys for fear of hurting response rates or frustrating customers. But the reality is, longer surveys can still be highly effective.

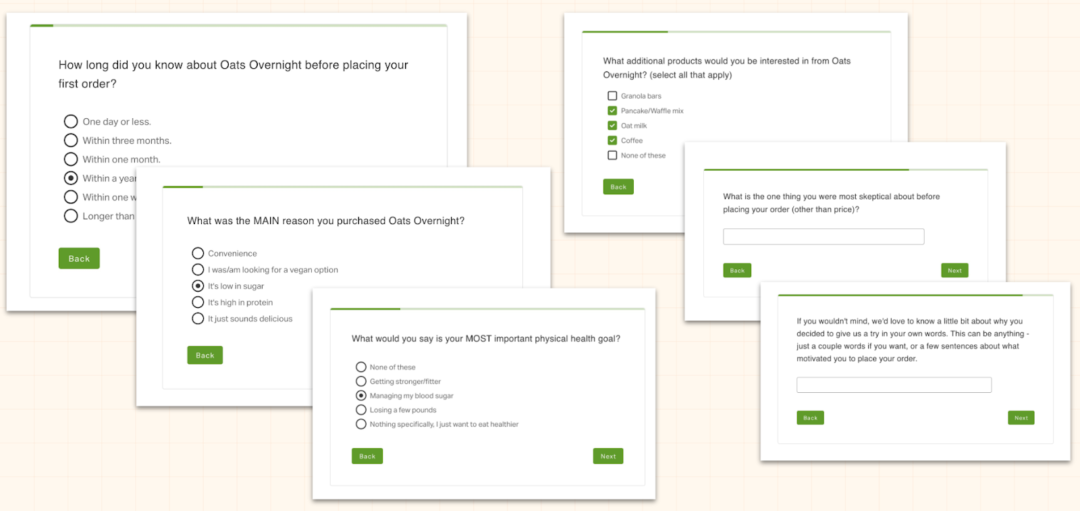

For example, Oats Overnight runs a 20-question survey that boasts a 58% response rate and 77% completion rate. The more data you collect, the more you can fine-tune your marketing and customer experience strategies.

Now, steal BrüMate’s PPS strategy

Another great example comes from BrüMate, who use surveys well before BFCM to optimize their holiday messaging and targeting. They ask questions like:

- When do you plan to start your holiday shopping?

- How much do you plan to spend per person on gifts?

- What would discourage you from buying from us this holiday season?

- What do you look for most when shopping for gifts?

- Which channels do you use most for holiday shopping inspiration?

- How likely are you to use Buy Now, Pay Later?

Armed with these insights, BrüMate was able to fine-tune their BFCM strategy. They learned, for example, when to start promotions, which channels to prioritize (such as Pinterest), and which products or pricing strategies to emphasize.

They even uncovered reasons why some customers might hesitate to buy, allowing them to preemptively address these concerns.

Interestingly, BrüMate also discovered that many of their one-time customers only return during BFCM.

Psst… don’t overlook one-time purchasers

While some brands might dismiss these one-time shoppers in favor of focusing on loyal customers, BrüMate saw an opportunity.

By strategizing how to maximize value from this group, they were able to make the most of their BFCM marketing efforts.

This raises an important point: instead of solely targeting big spenders or loyal customers, it’s worth focusing on these “lower-impact” customers—as long as your data shows they can be profitable.

But how can you find that out? Simple—ask questions like:

- How much do you plan to spend this holiday season?

- Are you a first-time or repeat customer?

- What types of deals do you prefer during BFCM?

The responses will help you understand if these customers are worth pursuing. And if they are profitable, you can double down on targeting them.

If they’re not, you can gather insights into why they don’t buy more often, giving you areas to improve—whether it’s messaging, product offerings, marketing, or customer experience.

Set up your PPS now

The window of opportunity is now. By setting up your PPS today, you’ll have time to gather three months’ worth of valuable data before BFCM. This will give you insights into why your customers buy—and, more importantly, how you can keep them coming back.

Think of it as letting your customers speak for themselves and using that data to craft a finely-tuned promotional calendar for the holiday season. Missing out on this data means missing out on key opportunities to optimize your strategy.