Research shows that 91% of people believe companies should drive innovation by listening to customers.

But how do you consistently tap into those insights?

At KnoCommerce, we partner with over 4,000 brands to design post-purchase surveys that uncover the marketing channels to invest in, product improvements to make, and messaging tweaks that resonate with real customers.

Here’s your chance to benefit from what we’ve learned working alongside these brands—read on to see how you can take customer feedback to the next level.

Exploring post-purchase survey types: Which works best for your brand?

Two main types of post-purchase surveys serve two different purposes:

On-Site checkout surveys: Capture the moment

On-site surveys engage customers right on your website as they browse, typically appearing as banners, embedded forms, or pop-ups. Post-purchase surveys, however, are embedded directly on the checkout confirmation page, which is shown to customers immediately after they complete an order.

The big advantage? The post-purchase moment is ideal for gathering customer feedback because it offers minimal friction in the customer journey.

At this stage, customers have already completed their purchase, so there’s no risk of interrupting or distracting them during their buying process. This timing lets you capture their honest reflections while their experience is still fresh.

Additionally, surveying recent purchasers provides valuable insights into their shopping experience and engagement levels—crucial data that can help you refine future interactions and encourage repeat purchases.

Link surveys: For Deeper, reflective responses

Link surveys, on the other hand, are shared post-shopping through channels like email or SMS, usually as part of a post-purchase follow-up.

The benefit of link surveys is that they often yield more thoughtful and detailed responses. Free from the distractions of the shopping process, customers can take their time answering questions in more depth.

The downside? Link surveys tend to have lower response rates. With many customers skipping marketing emails altogether, getting them to open and engage with the survey link can be a challenge.

Getting started with your post-purchase survey

You can break up the process in two simple steps:

- Segment customers into new vs. returning.

Dividing your customers by new and returning status allows you to tailor questions specifically to each group. This segmentation not only personalizes the survey experience but also helps you gather more relevant, targeted insights. - Ask questions that drive impactful change.

The questions you choose are crucial to the quality of feedback you receive. Thoughtfully crafted questions should align with your brand’s current growth stage to yield insights that truly move the needle.

For instance, a brand in its early growth phase might focus on questions around brand awareness and marketing channels, while a more established brand could explore feedback on potential new products or untapped demographics.

Kno-ing the difference: Response rate vs. completion rate

If you plan to implement post-purchase surveys into your ecommerce strategy, you must know the difference between response and completion rates.

These are NOT the same metric—and many people mix this up.

First, let’s break this down:

- The response rate is the percentage of people who START your survey, measured from the total sample of customers you’re asking to fill out.

- The completion rate is the percentage of those who COMPLETED the survey. Typically, we see that a 5-6 question survey reaches completion rates around 90%.

Now, let’s make this real to see when this discrepancy matters.

Recently, one of our bigger customers ran a 25-question post-purchase survey, which reached a 41% completion rate. While this is already impressive, the completion rate was around 90% when you isolated those first 5-6 questions.

This is important because people started their surveys without knowing the final length and answered the most important questions before dropping off. Then, the rest of the respondents answered up to twenty more questions. Even more impressive.

The moral of the story? Shorter is NOT always better when running post-purchase surveys.

Survey engagement secrets: Strategies to keep customers clicking

Boosting survey engagement starts with asking an approachable first question and strategically mixing open- and closed-ended prompts to minimize drop-offs and maximize valuable insights.

Here’s a guide to optimizing every part of your survey, ensuring it captivates customers and keeps them engaged through to the end.

Start with a low-commitment question

Ease customers into the survey with a straightforward, low-stakes question. This reduces the initial commitment and encourages them to continue. Here are some examples:

- Multiple choice questions. How do you prefer to receive updates from us? Options: Email, SMS, Social Media, or Other.

- Simple Y/N questions. Did you find the information on our website helpful?

Use a mix of open-ended and closed-ended questions

Open-ended questions prompt customers to share a more detailed perspective and deeper reflection on their shopping experience, revealing a comprehensive understanding of your customers.

On the other hand, close-ended questions ask customers quick and straightforward questions to get more narrow or clear answers.

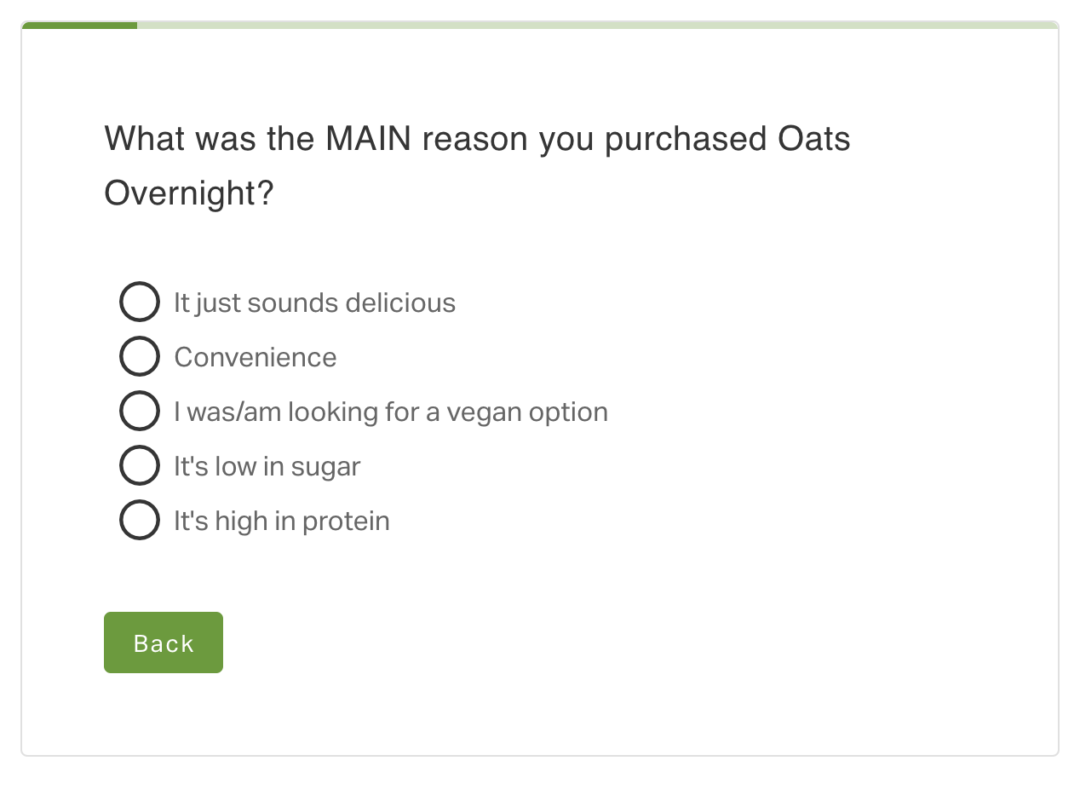

Need to see this in action? Oats Overnight, a protein oatmeal brand, developed a twenty-question survey with KnoCommerce that saw a 58% response rate and a 77% completion rate.

The brand got a complete picture of who their customers truly were with the help of twenty engaging questions.

Drive action at the end of the survey

End the survey by integrating re-acquisition channels by adding a call-to-action (CTA) at the end of the survey so the customer can re-engage somehow.

Things like referrals, mobile outreach, email/SMS campaigns, loyalty initiatives, and social media interactions are all compelling CTAs that foster continuous customer engagement and nurture brand relationships.

KnoCommerce gets a 45% average response rate on its surveys, which is the perfect place to encourage a lot of high-intent traffic to engage with CTAs.

For Only Curls, a curly-hair-friendly product brand, they were able to push new and repeat customers to download their app. And it worked — with KnoCommerce, they drove an extra 1k clicks to their download page in 2 months. These 1k customers can use the Tapcart mobile app to re-order and have a deeper relationship with Only Curls. Read more about it here.

Types of questions to ask in a post-purchase survey

Figuring out the right questions to ask your customers can be intimidating. Lucky for you, we’ve compiled a list of survey questions broken down by purpose, giving you post-purchase survey inspiration.

Want a spreadsheet of 200+ questions you can filter by vertical? Click here.

attribution-based survey questions

These questions help you understand what influenced a customer’s decision to make their purchase.

- How did you first hear about us?

- What encouraged you to come back and shop today?

- Do you always wait for a sale before purchasing on our site?

- Did you notice our brand partnership with [brand/influencer]

- Do you make more purchases online or in person?

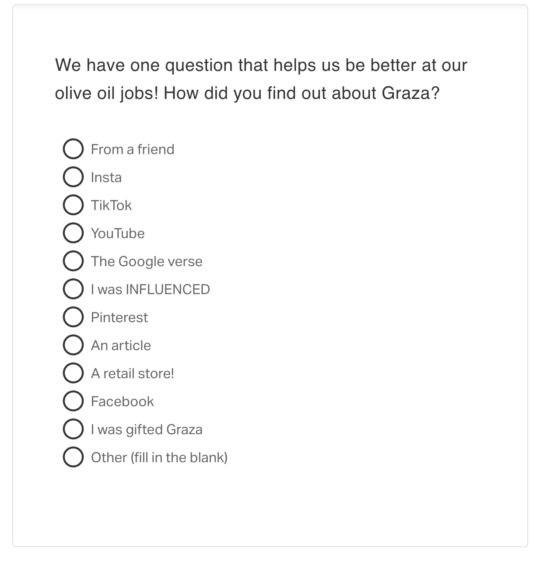

Check out how Graza and KnoCommerce used attribution-based questions to gather insights into how customers discovered Graza, helping them understand the effectiveness of their marketing strategies.

Market expansion survey questions

This category refers to asking questions about expanding into a new market.

Take this example. If a cookware business that sells high-end pots and pans wants to expand into the baking market, they would ask questions like:

- Do you bake?

- How often do you bake?

- What bakery items do you like to make?

These questions help the company understand what items or product lines may be most interesting to your consumers if you expand into a new market.

Product innovation questions

These questions focus on gathering insights or feedback on potential new product launches or features.

- Who do you want to see us collaborate with?

- Do you prefer to mix and match your bundles or buy a pre-made collection?

- What flavors, colors, or patterns do you want to see us do next?

- If you could change one thing about our product, what would it be?

- What problem can this product help you solve?

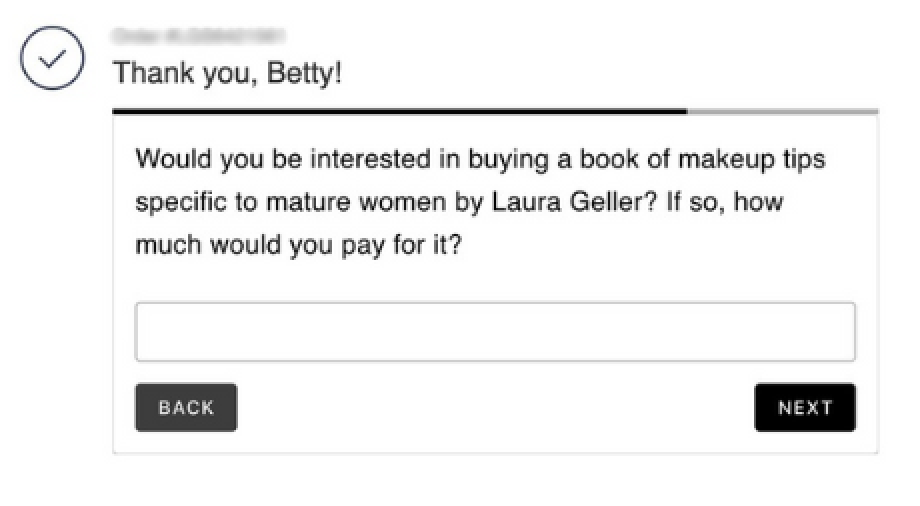

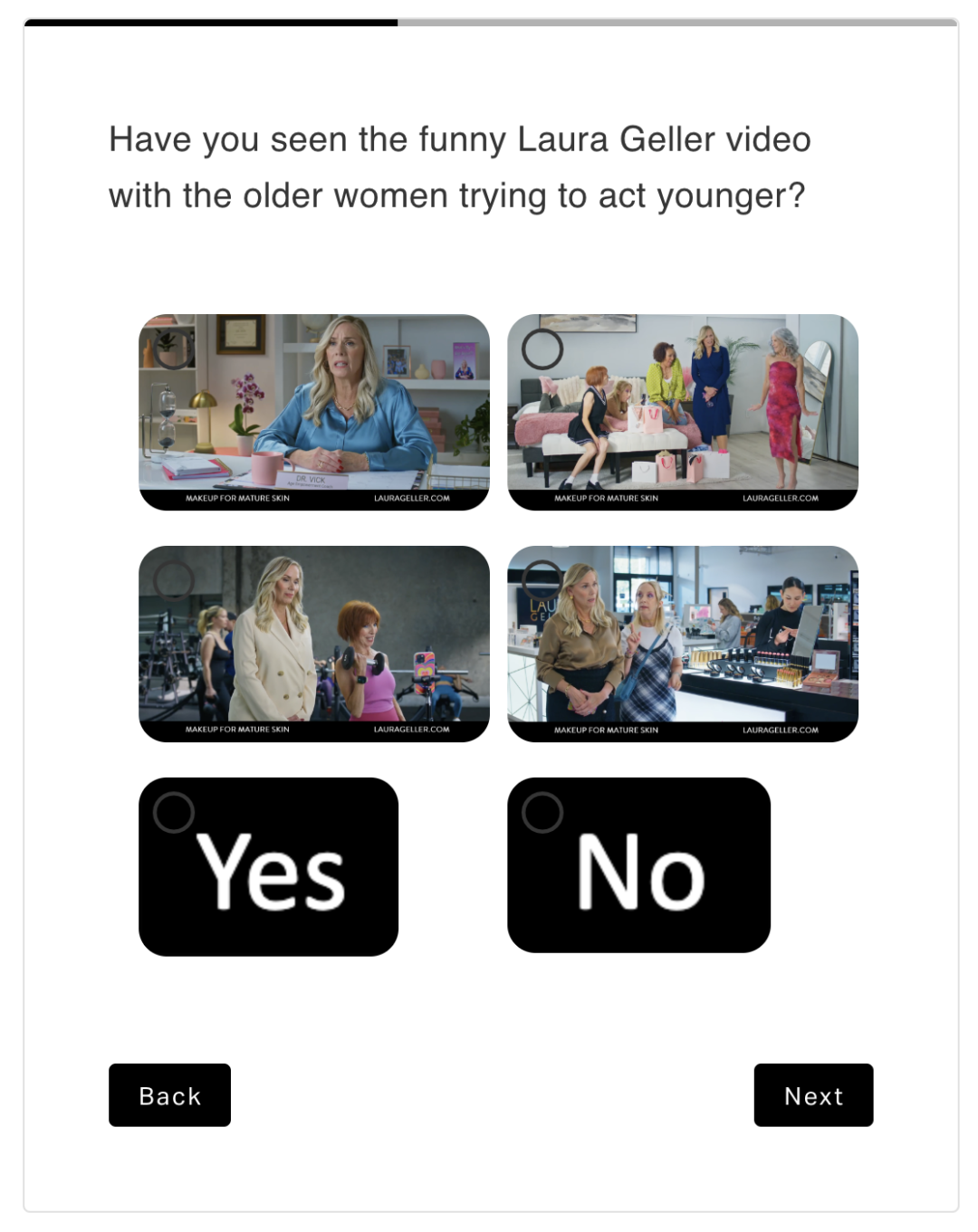

Check out how Laura Geller was able to implement product innovation questions in their post-purchase survey for the purpose of product development.

Holiday-based questions

BrüMate uses surveys well before BFCM to optimize its holiday messaging and targeting. They ask questions like:

- When do you plan to start your holiday shopping?

- How much do you plan to spend per person on gifts?

- What would discourage you from buying from us this holiday season?

- What do you look for most when shopping for gifts?

- Which channels do you use most for holiday shopping inspiration?

Armed with these insights, BrüMate was able to fine-tune its BFCM strategy, learn when to start promotions, which channels to prioritize, and which products or pricing strategies to emphasize.

They even discovered reasons some customers might hesitate to buy, allowing them to address these concerns preemptively. Interestingly, BrüMate also discovered that many of their one-time customers only return during BFCM.

While some brands might dismiss these one-time shoppers to focus on loyal customers, BrüMate saw an opportunity.

Instead of solely targeting big spenders or loyal customers, it’s worth focusing on these “lower-impact” customers—as long as your data shows they can be profitable. But how can you find that out? Simply ask questions like:

- How much do you plan to spend this holiday season?

- Are you a first-time or repeat customer?

- What types of deals do you prefer during BFCM?

The responses will help you understand if these customers are worth pursuing and if you should double down on targeting them.

Remember, even if they’re not profitable, you can gather insights into why they don’t buy more often, giving you areas to improve—whether it’s messaging, product offerings, marketing, or customer experience.

Net promoter score questions

Net Promoter Score (NPS) surveys are used to ask questions to measure customer loyalty and satisfaction. Here are some examples:

- On a scale of 0 to 10, how likely are you to recommend our product/service to a friend?

- How would you rate your overall experience with our product/service?

- How likely are you to purchase from us again in the future

- How would you rate your online shopping experience?

- What was the primary reason for your score?

Conversion rate optimization questions

Conversion Rate Optimization (CRO) surveys are questions that help you unpack why online visitors may not be reaching the point of converting. Here are some effective CRO survey questions:

- On a scale of 0 to 10, how easy was it to navigate our website?

- Did you find all the products you were looking for?

- Were you satisfied with the payment options available?

- Was there any part of our store that was difficult to use?

- What would have made your shopping experience better?

Customer behavior questions

These questions are great to help you interpret and understand how your shoppers interact with your product or service. When thinking about implementing customer behavior questions, consider these:

- How often do you purchase products from us?

- What is your main reason for using our product?

- Which features of our product do you find most valuable?

- How much research do you do before making a purchase?

- How much do product reviews influence your purchasing decisions?

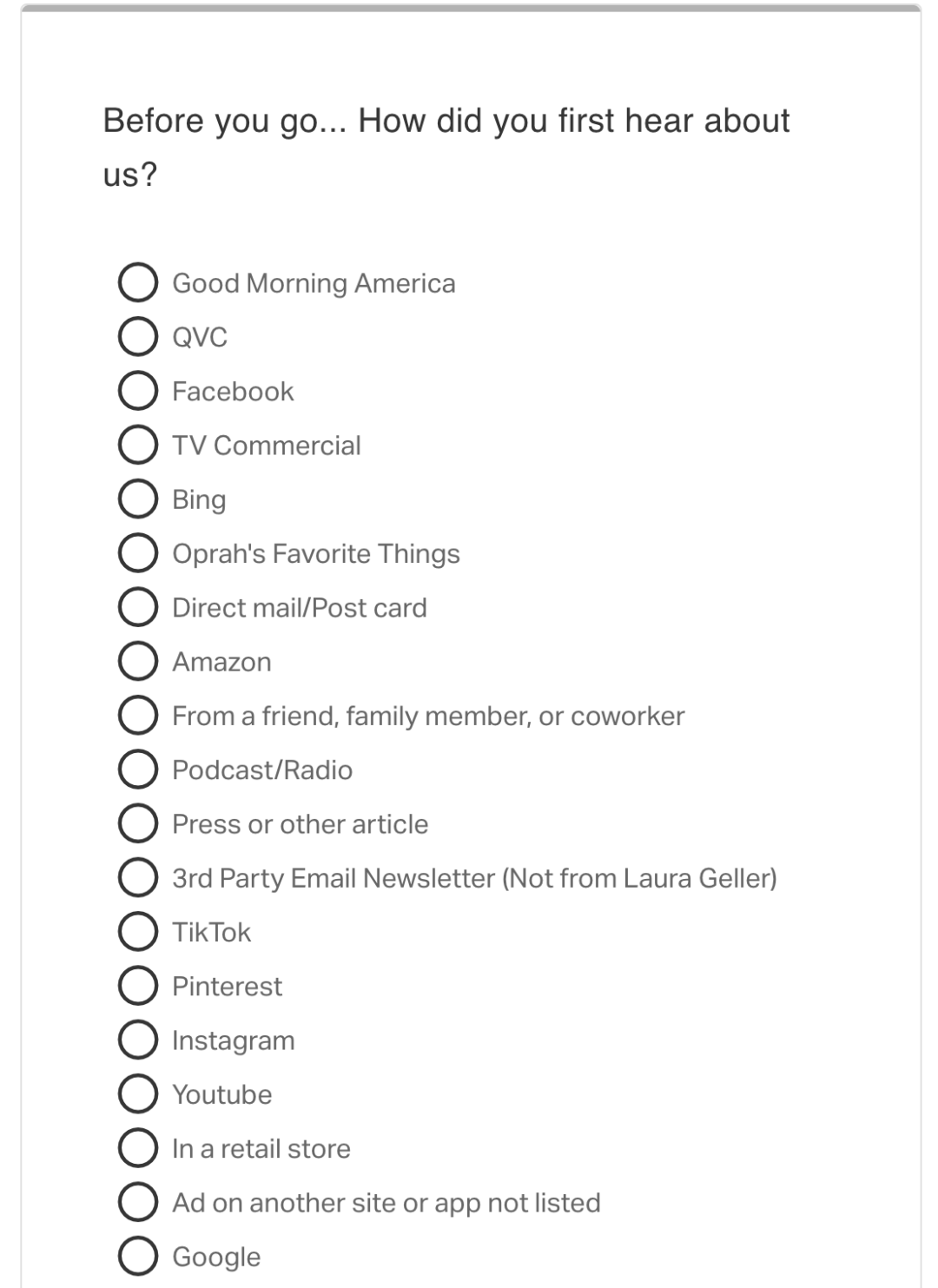

Success story spotlight: How Laura Geller mapped the customer journey

Here’s a look into the survey questions designed to map the customer journey from discovery to purchase.

In the case of Laura Geller, they started by asking, “Before you go…How did you first hear about us?” This question is pivotal in identifying the initial touchpoint.

They follow up by asking, “What brought you to the site today?” which helps pinpoint both the initial and final touchpoints in the customer journey.

There’s much more happening in between these stages. The frequency of touchpoints before a purchase can vary greatly, and capturing this is key.

One of their follow-up questions provided them with valuable insight. If a respondent mentions discovering Laura Geller through a digital channel, the survey asks if they also saw their TV commercial. This approach shows insight into the synergy between TV and digital channels, reinforcing TV as a powerful top-of-funnel strategy.

These synergies achieved a 2.5 to 3x incremental increase in revenue from TV channels, allowing Laura Geller to double their TV advertising budget and maintain their return on ad spend ROAS targets.

Want to see more real-life examples? Read more about our use cases here.

Start with a template using KnoCommerce

Now that you know more about what post-purchase surveys can do for your business, are you ready to see how we can help you achieve similar results?

Schedule a demo with us today, or sign up for a free 7-day trial (no strings attached) and get started with a template in minutes.