Old-school CRO isn’t dead—it’s just incomplete.

Sure, heatmaps, click tracking, and A/B tests still have their place. But if you’re only looking at those signals, you’re missing out on the insights that actually move the needle.

As our General Manager, Bar Bruhis, says… “If you think you know your audience, put your ego aside and start asking them.”

Relying solely on traditional analytics to guide CRO only gives you half the story. We’re not saying that you need to ditch these old ways; we’re saying that you need to combine them with new CRO tactics.

New CRO is based on conversations.

Instead of guessing why a customer didn’t convert or what made them say yes, you ask them. And the best time is right after they buy, when their attention is high and their memory is fresh.

Why Post-Purchase Surveys Are Having a Moment

Right after a purchase, your customer is in what we like to call a “first day of school” mindset. They found something they needed. You earned their trust. That moment is golden.

But if you want to turn that one-time win into long-term growth, you’ve got to listen.

That’s where post-purchase surveys come in—and they’re a game-changer for CRO.

Shoppers are in a reflective, decision-confirming mindset immediately after buying. It’s the perfect time to ask smart questions. On average, you can collect 6–8 valuable data points per survey—insights you won’t get from heatmaps or click tracking alone.

And unlike generic feedback tools, post-purchase surveys give you actionable insights that directly inform your optimization strategy:

- Attribution: How did you hear about us?

- Motivation: What made you decide to buy today?

- Friction: What almost stopped you from buying?

When you combine these insights with traditional metrics like conversion rate, bounce rate, and AOV, you start to see the whole picture, not just what customers did, but why.

That’s exactly what QALO did.

What QALO learned when they actually asked why people were buying

QALO is a great example of what’s possible when you go beyond basic questions and let survey logic do the heavy lifting.

They originally launched as a silicone ring company—designed for people who didn’t want to wear their wedding band while climbing, traveling, or working out. But when they introduced their silicon dog ID tags, they started asking customers what drove their purchase.

First, they asked: What brought you in today?

Customers could choose from options like wedding rings, dog ID tags, or even a biometric ring QALO had recently launched. Based on each response, the survey would automatically trigger a custom follow-up to dig deeper into that specific product path.

For example, if someone said they were buying a dog ID tag, the follow-ups might include:

- Why did you choose this particular tag?

- Where do you plan to use it?

- What kind of dog is it for?

The results were eye-opening. While QALO still had a strong wedding ring audience, dog ID tags were rising fast—and not just as an add-on, but as a top reason people were discovering and purchasing from the brand.

So they acted on it.

If you visit QALO’s site now, you’ll still see rings front and center—but you’ll also notice dog ID tags featured prominently, backed by messaging that came directly from survey responses. They even reshaped parts of their go-to-market strategy based on what customers told them.

Because here’s the thing: data sitting in a dashboard is useless if you’re not doing anything with it. QALO didn’t just collect insights—they used them to drive smarter, faster CRO decisions.

And that’s the real power of post-purchase surveys.

Now You Have the Data—Here’s How to Use It

Your work doesn’t stop after just implementing your survey.

One of our favorite quotes from Bar is: “Data is worthless if it’s just sitting in your dashboard. If you’re not actually doing something about it, it’s kind of a waste of time.”

It’s all about finding actionable insights and takeaways that inspire improvement. Here is a simple way to start:

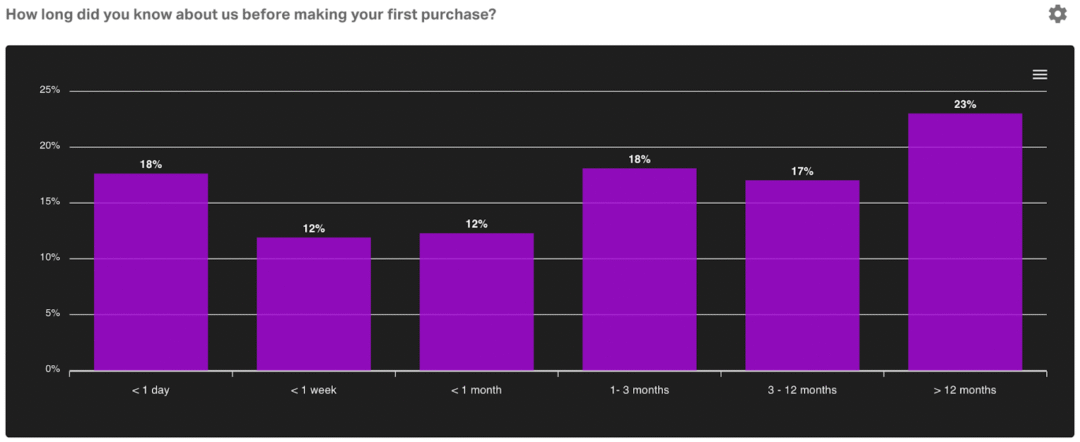

- Figure out your conversion cycle. By asking the right questions, you can find out on average how long it takes for a shopper to make the purchase. Shorter cycles often mean that there’s a strong alignment between what you’re offering and what your audience wants.

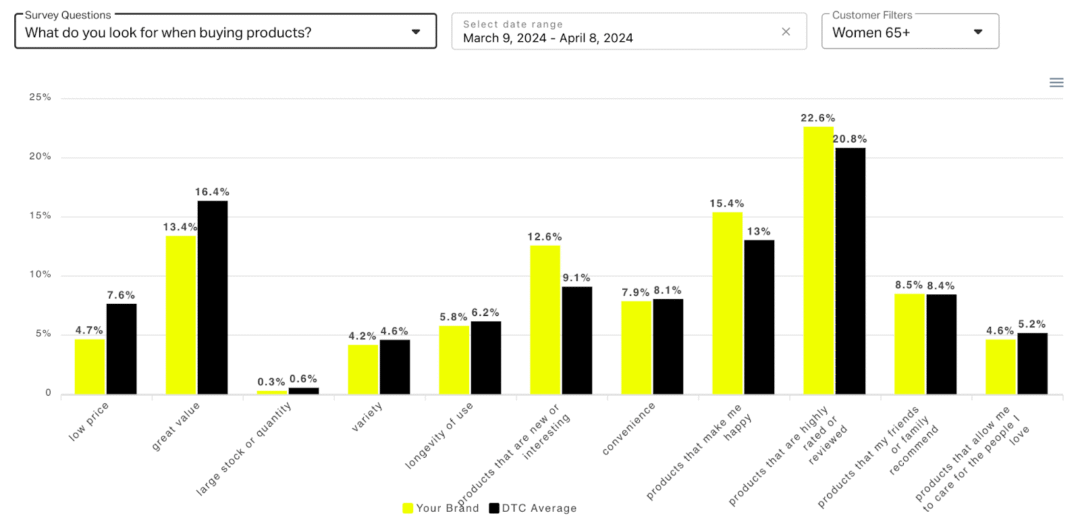

- Understand customer motivations. Getting insights into what prompts specific customer segments to buy your products can help you tailor your marketing strategy and targeting to effectively prompt conversions.

- Ask different questions to your loyal audiences. Want to know how to get more customers like those ones that have stuck with your brand? Just ask! Your already loyal customer base will tell you everything you would want to know about acquiring the same type of customer.

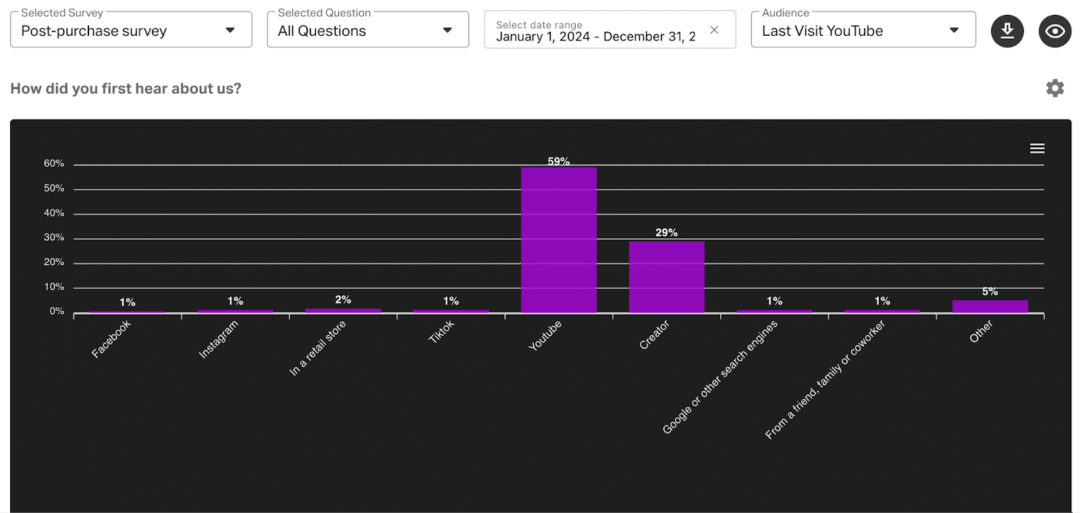

- Evaluate your landing pages. By determining what channel customers came from, you can infer which channel-specific landing pages are doing well… and which may need revision.

- Authenticate through video surveys. With Kno, you can gather video surveys and you can prompt them through AI, which will summarize videos and contextualize that data so that you can actually make changes similar to these post-purchase surveys.

Like Kno’s General Manager says, “The goal is not to stop traditional CRO, it’s to combine both the old with the new. To triangulate all of that information and drive to better results.”

The Importance of Combining Both Traditional and New CRO

You know how frustrating it is when you drop a puzzle piece or lose one, and you just can’t see the full picture? You kinda know the picture, but like… you don’t really know. Consumer insights are like the missing piece to the puzzle you’re trying to solve with your customers.

By combining both traditional data and new CRO, you’re seeing things more clearly—and in more depth than what a simple number would have shown.

It’s the brands that pull both qualitative and quantitative data via consumer engagement that can:

- Truly understand buyer intent across channels, pages, and products

- Identify pain points that limit conversion, and therefore points you in the direction of where to improve.

- Optimize every part of the customer journey, not just the checkout page.

Sometimes numbers don’t tell you the full story, that’s where surveys come in as the missing piece. And what conclusions can surveys help you pull? They can help:

- Identify top creators and ad campaigns that drive intent.

- Optimize ad creative and landing pages to help with conversion.

- Seeing the impact of individual channels in your broader media mix.

- Refine navigation, search functionality, product categorization, and personalized upsells.

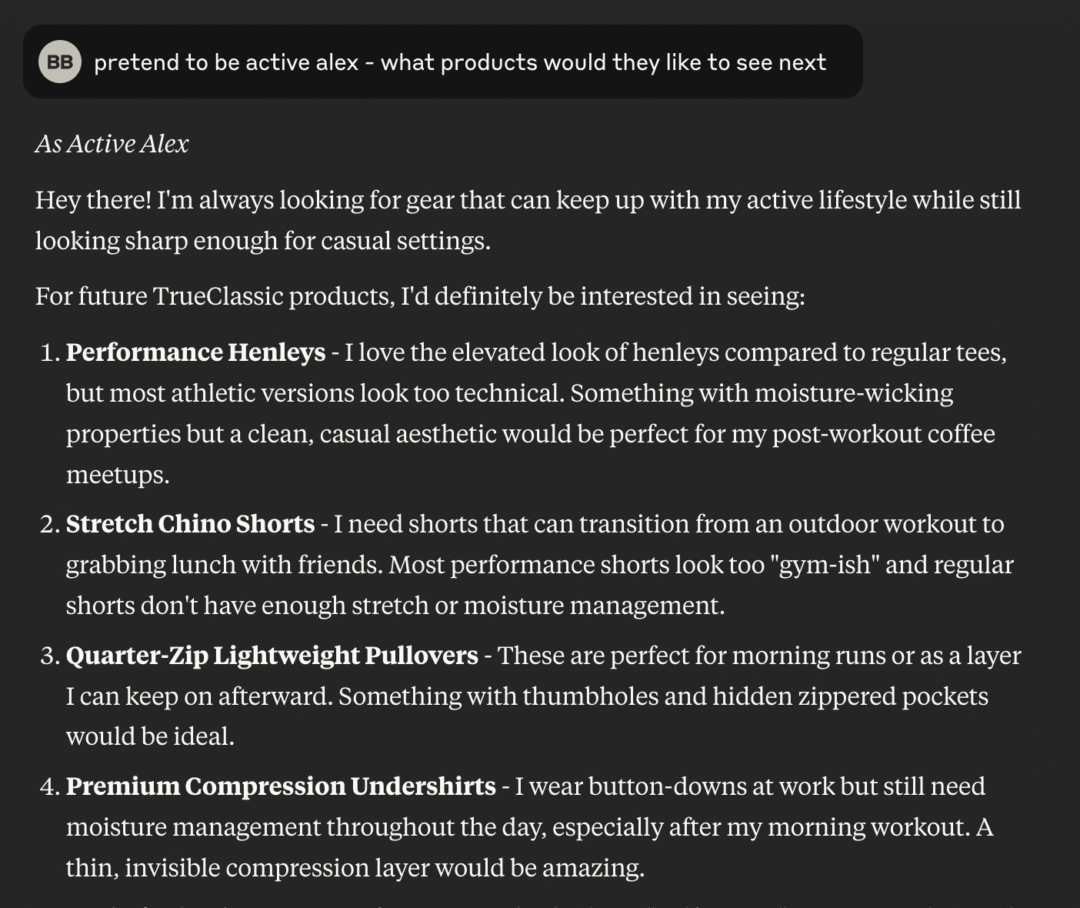

- Talk to your ideal customer, especially using AI.

Where AI Fits Into the Picture

A little sneak peek: we’re building AI into the platform because we recognize its influence and strengths.

With AI, you can actually upload all your data and create personas that you can talk to. It’s a way to get even more personal with the personas of your shoppers, so you can understand and listen to them much better.

You’ll be able to simulate real conversations, refine messaging, and deepen your understanding of different customer types—without guesswork.

It’s an awesome feature, and we’re excited to bring more developments to this soon.

More Examples from Brands Using Surveys to Guide Growth

From uncovering friction points in the funnel to influencing full-on product launches, here’s how brands like True Classic, Grüns, and HexClad are turning survey insights into growth.

True Classic

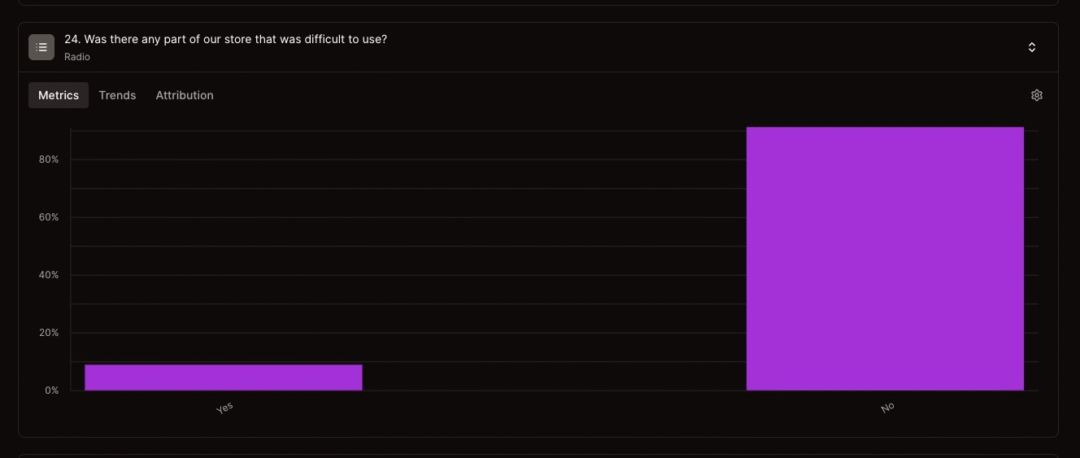

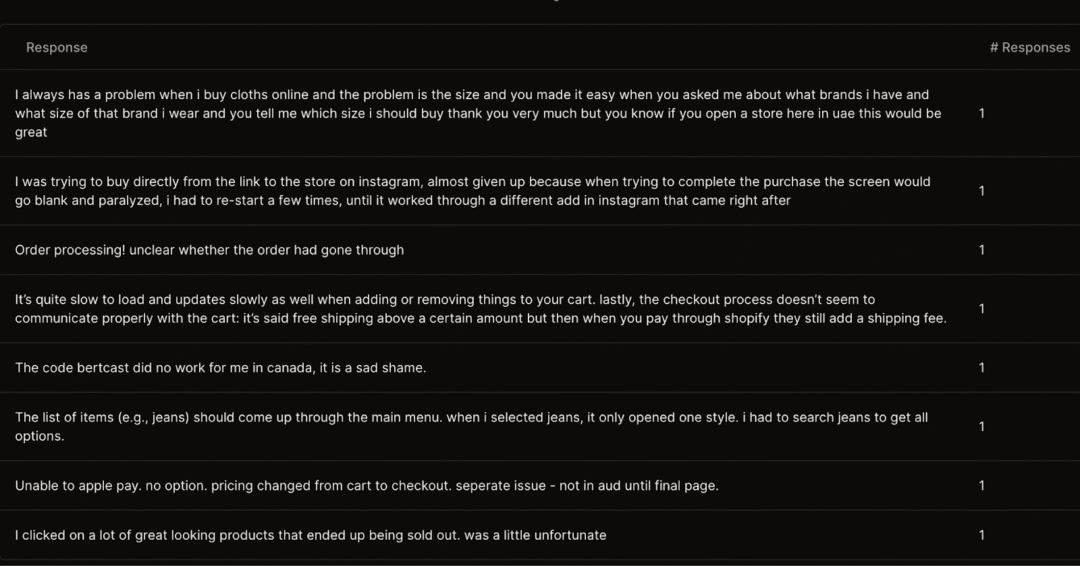

The men’s apparel company asked shoppers which parts of the website UX were challenging to use or may have caused friction in their shopping process.

Shoppers were prompted with a simple “Yes” or “No” question, and based on the responses, True Classic followed up with an open-ended question to ask how they could improve.

This not only gave easily digestible data via the “Yes” or “No” question, but also more detailed data to dive deeper into the consumer experiences.

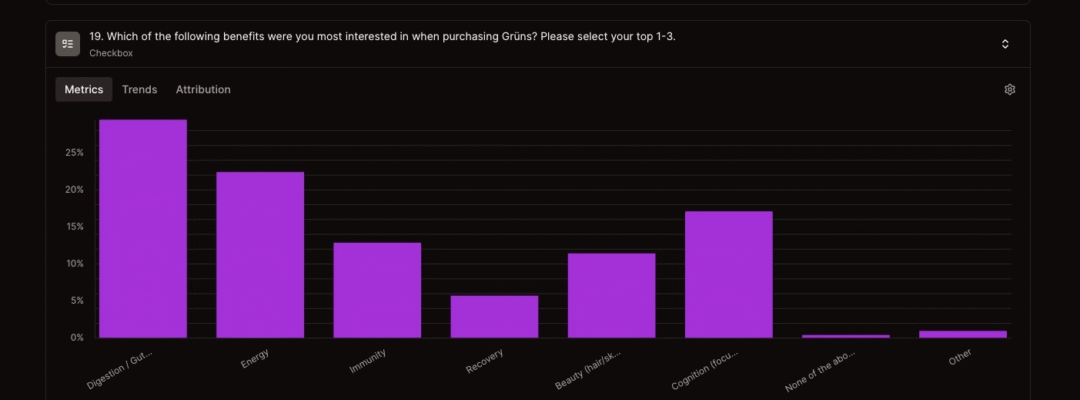

Grüns

Grüns, the nutritional ‘smart gummy’ provider, uses post-purchase surveys to help them discover purchase attribution. They implemented open-text survey questions to understand why customers decided to buy from them specifically.

From there, they could figure out if shoppers were coming from a competitor, and which specific ones. This gave Grüns an upper hand, pinpointing both their differentiating factors and weaknesses amongst competitors.

Hexclad

The cookware company was able to match insights from survey feedback to intentional action that guided R&D:

- Grilling frequency.

-

- Insight: 30% grill 5+ times per month

- Action: Launched Summer Grilling line

- Seeing if their customers bake as well as cook.

-

-

- Insight: 60% bake 5+ times per month.

- Action: Expanding into baking products

-

- Exploring consumer habits.

-

- Insight: 38% of shoppers take their lunch daily.

- Action: Investigating food storage products

By launching these surveys, Hexclad was able to learn more about its customers and identify and cater to their unmet needs through product development.

Why with KNO

We’ve been doing this for years, and we’ve mastered it. When it comes to CRO, talking to your customer is the clearest path to better results.

With Kno, you can:

- Uncover friction points before they become problems

- Optimize based on real buying motivations

- Get survey insights at scale—with or without AI

We process millions of data points every month. So if you’re ready to try this out or just chat, hit us up. We even offer managed services, called IINSIGHTS, which you can apply to here.