Marketers everywhere breathe a sigh of relief after Black Friday/Cyber Monday—we’ve made it through the 2024 season. So, how did the biggest shopping event of the year stack up against BFCMs past? What are this year’s Black Friday Cyber Monday lessons?

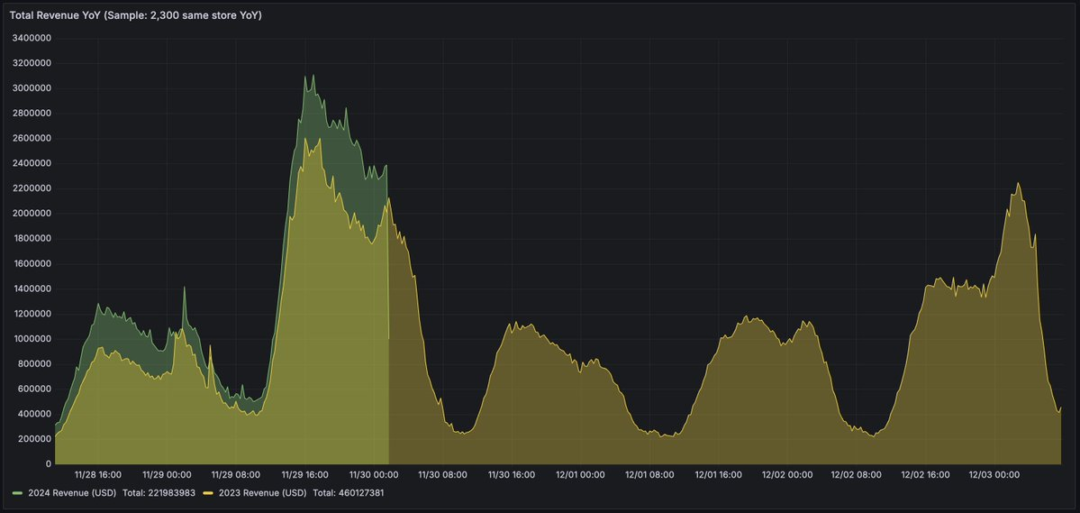

We crunched the numbers for 2,300 Shopify stores to get the inside scoop. From revenue growth to shifting trends, we’re breaking down the highs, the surprises, and everything in between for each day of BFCM week.

Let’s start with the biggest question…

The big question: did Shopify stores outperform 2023?

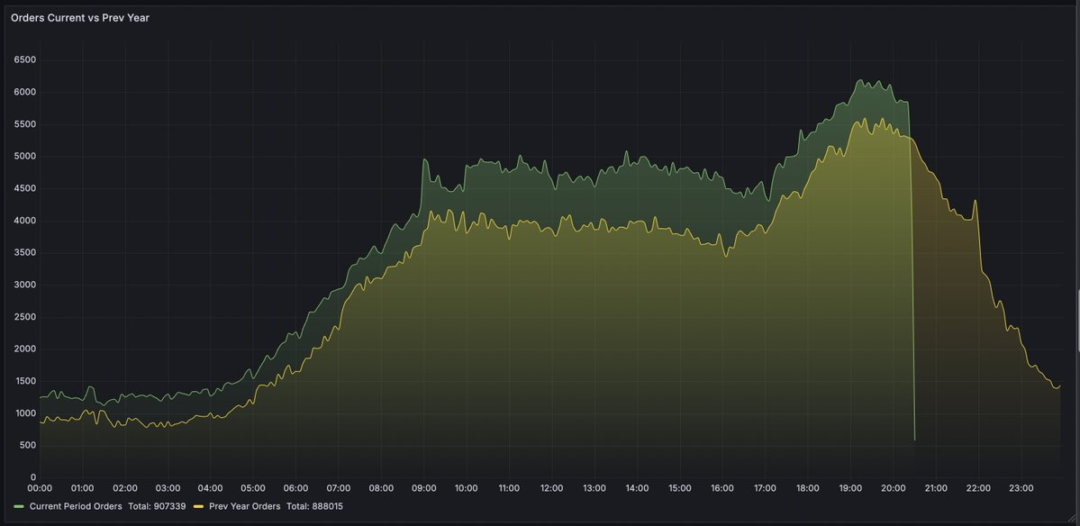

The short answer? Yes. The slightly longer answer? Shopify’s general merchandise value (GMV) is up, as is per-store revenue. On average, the brands in our dataset saw a 25.5% revenue boost compared to last year. Not too shabby, right?

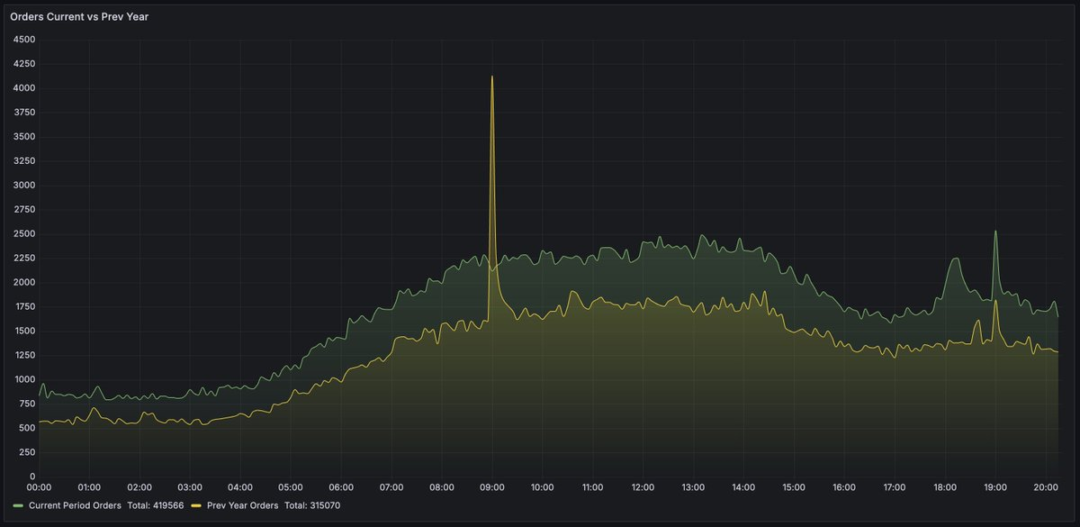

But here’s where it gets interesting: the pacing and timing of sales were strikingly consistent with 2023—until they weren’t. A closer look reveals that peak moments, like Black Friday, were softer than expected, while non-peak moments outshined last year.

Why the shift? Early sales. More brands leaned into pre-BFCM promotions, pulling in revenue that would’ve traditionally hit during Black Friday or Cyber Monday. In fact, stores saw a 58% jump in revenue the week before BFCM compared to 2023.

So, what does that mean for the future of BFCM? The lines are blurring. Shoppers aren’t waiting for the “official” kickoff—they’re ready to pounce as soon as deals go live.

To summarize, here are a few key takeaways that stood out this year:

- Shopify GMV is on the rise. Our tracked brands saw a 25.5% YoY growth. Meanwhile Shopify tracked a 24% YoY growth, with total Shopify GMV coming in at $11.5B

- Revenue growth was consistent, but timing shifted. Per-store revenue grew 25.5%, although the biggest sales peaks were softer than in prior years. Interestingly, the week before BFCM was up 58%, indicating early sales may have pulled revenue forward.

- The trend is predictable. Year after year, the pacing and timing of sales during BFCM follow a highly reliable pattern. This predictability is a goldmine for brands looking to plan strategically for next year.

And here’s one more number we’re excited about: during this year’s BFCM, shoppers answered 15.3 million questions on KnoCommerce surveys. That’s data helping 5,000+ brands understand who their customers are and why they buy.

Alright, now that we’ve set the scene, let’s see how this played out day-over-day.

Tuesday: a slow burn

It was a slower start than expected, with sales even more conservative than Monday’s. While our sample stores were still up by 33% from last year’s BFCM Tuesday, they didn’t quite reach our YOY benchmark of 52% growth.

That extreme peak time spike from last year was replaced with a more moderate revenue trend, though our stores still outperformed last year’s sales nearly throughout the day.

Wednesday: underwhelming midweek

An underwhelming performance, with only a 12.2% increase in sales from a slow Tuesday. Last year, we saw a 15.5% day-over-day increase at this point in the week. Stores are still chasing the numbers they saw on Monday; yesterday, sales were down 7% from Monday compared to last year’s 0.2% drop.

One possible culprit? Reports suggest Meta’s ad spend took a backseat this year, impacting midweek momentum.

Thursday: the night before the big day

Twas the night before Black Friday, and all through the data, YOY sales volumes are up this week compared to 2023.

While overall, the total revenue has surpassed 2023 numbers so far, the day-over-day growth wasn’t so peachy.

Our sample stores didn’t quite gain the momentum they were looking for from Wednesday to Thursday, missing last year’s benchmark of a 27% day-over-day improvement at this point in the week.

Instead, there was a 19% increase from yesterday’s earnings, a more slow and steady ramp-up to Black Friday that we’re used to seeing.

Black Friday: still king, but…

Black Friday, the original impetus of the whole BFCM shopping season. Nowadays, it shares its hype with Cyber Monday, and even brick-and-mortar businesses’ extended sales periods.

The data backs up this ‘‘diluted’’ Black Friday hype: 22% improvement from 2023. For many businesses, it’s a more modest YoY increase than in previous years. Specifically, the data suggests that direct-to-consumer businesses were more likely to experience a lower YoY increase than expected.

But let’s focus on the positive: the numbers are still up (based on the $260M in revenue tracked so far), and Shopify reported significant YoY GMV growth in Q3; time will tell if the BFCM GMV will hit that 20-30% YoY growth target this year.

Saturday: a surprise contender

Our sample stores enjoyed a surprisingly strong Saturday this year, with a 30% improvement compared to last year.

This year’s BFCM Saturday was also closer to closing the gap in day-over-day sales than Black Friday; businesses saw only 31% less revenue on Saturday from Friday, compared to the 38% dip recorded for 2023.

Among our sample cohort, the 2024 BFCM weekend as a whole will go on to outpace last year’s by 22%.

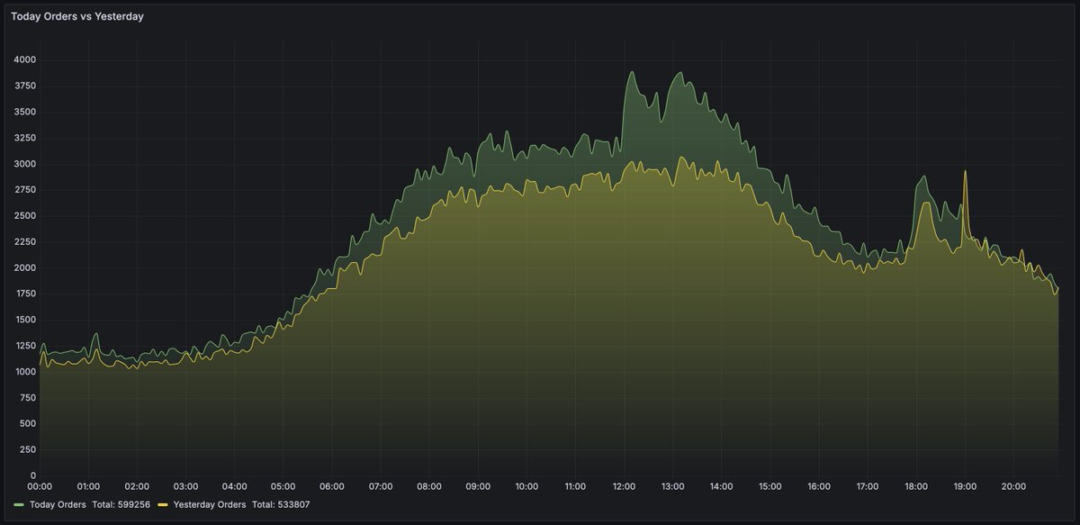

Sunday: a sneaky strong finish

Sunday sales started deceptively low, with a slower start to the day than on Saturday.

But by late morning, volumes were ramping up dramatically. Just like in 2023, Sunday sales outpaced Saturday’s by mid-afternoon, culminating in a total 4.5% day-over-day increase.

It’s also time for a Cyber Monday-eve pulse check: Heading into the weekend, our sample stores were trending a 21% YoY improvement from their 2023 numbers; on Sunday night, that’s grown to 26%.

The goal is to maintain a YoY growth rate of at least 25% as we move into the final stretch. So, did we make it?

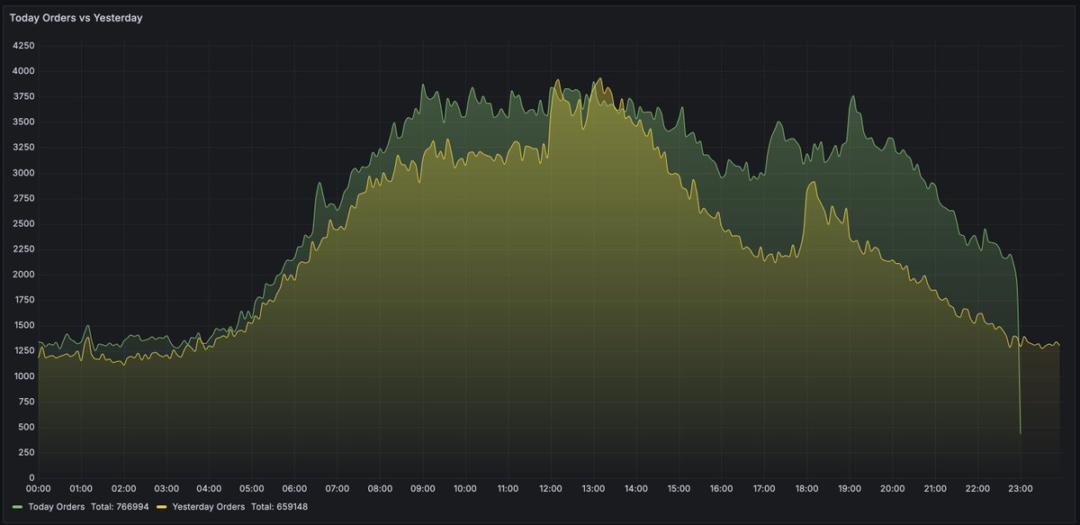

Cyber Monday: closing strong

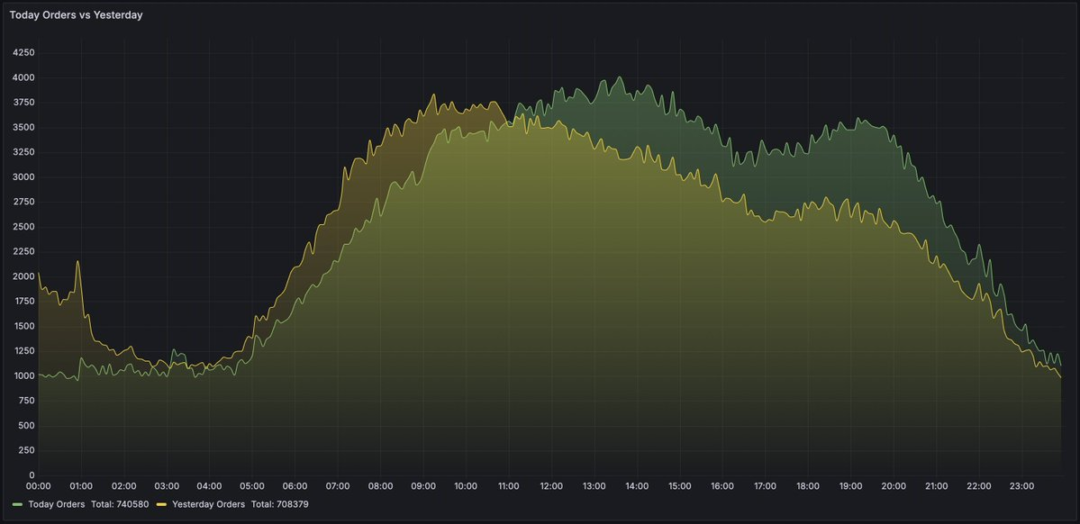

As expected, Cyber Monday sales began to pick up later in the day as shoppers returned home from work and started making their purchases.

The whole day played out as expected, with the pacing trends closely following what we saw in 2023. Cyber Monday 2024 revenue was 21% higher than last year’s, similar to the growth rate on Black Friday.

By the end of the day, our sample stores reported an overall 25.5% improvement in BFCM week revenue compared to last year.

What we learned from BFCM 2024

This year was a masterclass in adapting to changing consumer behaviors. While the traditional peaks of Black Friday and Cyber Monday softened, early sales created new opportunities.

Here’s what brands should take away:

- Embrace early promotions. Shoppers are eager to buy before the official “start” of BFCM. Meet them where they are.

- Optimize pacing. Non-peak days are growing in importance, so keep your campaigns active throughout the week.

- Stay flexible. With consumer habits in flux, agility is key. Pay attention to the data, and don’t be afraid to pivot.

Ultimately, this year’s data reminds us that flexibility and consumer-centric planning are essential.